Data was collected from selected members of Malaysia Retailers Associations (MRA) on their retail sale performances during the first quarter of 2020.

FIRST 4 MONTHS OF 2020

The Malaysia retail industry growth rate in January 2020 is estimated to drop by 13.8% (see Table 1), as compared to the same month a year ago. Slow sale during Chinese New Year period and the drop in tourists from China were the main contributing factors.

TABLE 1: MALAYSIA RETAIL INDUSTRY GROWTH RATE, FIRST 4 MONTHS OF 2020

*- April retail growth rate is based on retail performances of essential retailers during first 2 weeks of MCO Source: Malaysia Retailers Association/ Retail Group Malaysia

During the second month of this year, retailers continued to suffer with an expected negative growth of 20.1%. The rapid spread of covid-19 and the drastic decline of foreign tourists led to this poor performance.

The fear of virus pandemic had affected consumers’ spending during the first 2 weeks of March 2020. The partial lockdown on the last 2 weeks of March led to zero revenue for non-essential retailers in the whole country.

For the month of March, the revenue of Malaysia retail industry is estimated to contract by 28.9% as compared to the same period in 2019.

For the first quarter of this year, Malaysia retail industry is expected to record a negative growth of 18.8% as compared to the same period last year.

The whole month of April remains under Movement Control Oder (MCO). Essential retailers continue to open with strict social distancing measures implemented by operators. Small number of non-essential retailers is allowed to open during the last 2 weeks of April.

Based on the retail sale performances of essential retailers during the first 2 weeks of MCO as well as the assumption of zero income for almost all the non-essential retailers, the month of April is expected to contract by 60.7% in retail sale as compared to the same month of 2019.

GROCERY RETAILERS DURING MCO

The business of grocery retailers climbed 20.9% during the first week of Movement Control Order (MCO) when Malaysians rushed to stock up foods and basic necessities (see Table 2).

Grocery retailers included supermarkets, hypermarkets, mini-markets, provision shops and convenience stores.

TABLE 2: RETAIL GROWTH RATE OF GROCERY RETAILERS, DURING MOVEMENT CONTROL ORDER , MARCH 2020

Source: Malaysia Retailers Association/ Retail Group Malaysia

During the second week of MCO, the shopping activities became normalised when Malaysians were able to plan their grocery needs wisely. As more Malaysians started to cook at home, grocery retailers enjoyed higher sales. On the other hand, the strict social distancing measures implemented by the retail operators affected the shopping traffic and sale receipt per person.

For the second week of MCO, grocery retailers enjoyed a growth rate of 9.5%.

BUSINESS LOSSES DURING MCO PERIOD

About 126,000 retailers (including 10% of stalls and markets) remain open during the Movement Control Order (MCO) period (see Table 3). They represent 37% of the total retail outlets in Malaysia. Their combined sale turnover accounts for 35% of the total retail turnover in the country.

On the other hand, more than 209,000 retail stores (including 90% of stalls and markets) were forced to shut down during the same period. They represent 61% of total retail outlets and 63% of total retail sale in the country. More than 732,000 retail employees are required to stay at home during this period without work.

TABLE 3: TYPES OF RETAILERS DURING MCO PERIOD

* Stalls and markets include retail operators in wet markets, morning markets, night markets, bazaars, streets, lanes and other outdoor areas.

# Other retailers include mail order houses, direct selling companies, vending machine operators and online retailers

Source: Department of Statistics Malaysia/ Malaysia Pharmacy Society/ Retail Group Malaysia

During the MCO period, non-essential retailers needs to pay for most of the retail operating cost even though their retail stores remain close. The total retail operating cost is estimated at RM14.3 billion during the 6-week period (see Table 4).

Retail operating cost of a retailer includes rent of retail premises, staff cost, utilities, head office expenses, insurances, taxes, advertising and promotional expenses, repair and maintenance costs, third-party professional services and others.

TABLE 4: COSTS OF OPERATION OF NON-ESSENTIAL RETAILERS

DURING 6-WEEK MOVEMENT CONTROL ORDER

Source: Retail Group Malaysia

During the 6 weeks of business closures, non-essential retailers still need to pay an estimated RM6.2 billion in staff cost including salaries and wages, allowances, KWSP contributions and SOCSO contributions.

YEAR 2020 PROJECTION

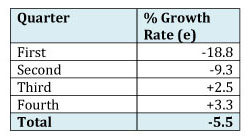

During the second quarter of this year, retail industry is expected to suffer a decline in sale by 9.3% (see Table 5). This projection takes into consideration the 4 weeks of MCO in April as well as the expected slow sale during Hari Raya festival.

TABLE 5: RETAIL GROWTH RATE, MALAYSIA, 2020

(e)- estimate

Source: Retail Group Malaysia

Assuming domestic economy will recover from the second half of this year, Malaysia retail industry growth rates for third and fourth quarters will be 2.5% and 3.3% respectively.

For the whole year of 2020, Malaysia retail industry is expected to suffer a decline in sale by 5.5% as compared to last year.

The previous year when Malaysia retail industry had a negative growth rate was 1998- the first year of Asian financial and economic crisis. In 1998, Malaysia retail industry contracted by 20%.

Prepared by Retail Group Malaysia

Footnotes :

- This report is provided as a service to members of MRA and the retail industry. It provides retail industry data during the Covid-19 pandemic.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA and their members.

- For more information, please write to tanhaihsin@yahoo.com.