PREAMBLE – Members of Malaysia Retailers Association (MRA) were interviewed on their retail sales performances for the last quarter of 2015 and their projection for 2016.

LATEST RETAIL PERFORMANCE

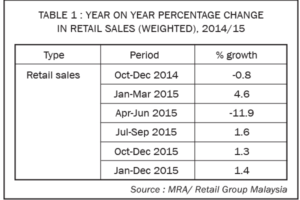

For the fourth quarter of 2015, Malaysia retail industry reported another disappointing performance of 1.3% in retail sales growth rate, as compared to the same period in 2014 (Table 1).

This quarterly performance met the expectation of MRA members (projected at 1.3% in December 2015), but below the estimated growth rate of 3.8% calculated by Retail Group Malaysia.

The year-end school holiday and festive season did not lift the buying spirit of Malaysian consumers. In addition, the higher cost of overseas travelling due to weak Ringgit did not encourage more domestic spending.

The weak Ringgit performance during the last quarter of 2015 had resulted in higher import costs. Higher import costs led to increased retail prices. Increased retail prices had further deteriorated the purchasing power of Malaysian consumers.

Despite heavy price discounts and aggressive promotions, retailers could not raise the consumers’ spending. During this latest quarter, they suffered further decline in profit margin growth.

For the whole year of 2015, Malaysia retail industry grew by a mere 1.4% as compared to the same period a year ago. The total retail sales turnover for 2015 was RM 96.2 billion.

Last year (2015) was the worst annual retail growth rate since 2010. In 2009, the retail industry growth rate was 0.8%.

This final retail result was below the estimate made by Retail Group Malaysia at 2.0% in December 2015.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

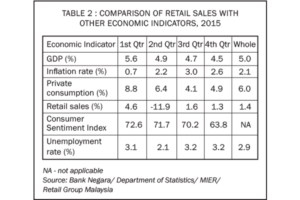

For the fourth quarter of 2015, Malaysia national economy recorded a slower growth rate of 4.5% (Table 2, at constant prices), as compared to 1.4% for retail sales (at current prices).

Inflation rate growth slowed down to 2.6% during the fourth quarter of 2015 due to declining fuel prices. In spite of that,n prices of almost goods and services rose during the same period.

Private consumption grew at 4.9% during the fourth quarter of 2015 due to stable labour market.

During this latest quarter, the Consumer Sentiment Index (by MIER) dropped to a new record low of 63.8. This was due to weakening job prospect and rising cost of living.

Unemployment rate maintained at 3.2% during the last quarter of 2015 as compared to the same period in 2014.

RETAIL SUB-SECTORS’ SALES COMPARISON

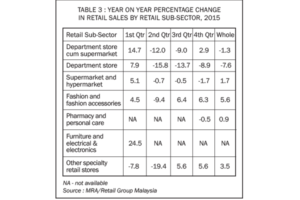

The latest quarterly growth rates among retail sub-sectors were mixed (Table 3).

Department Store cum Supermarket sub-sector managed to recover during the fourth quarter of 2015 with a positive growth of 2.9%, as compared to the same period a year ago. For the whole year, this sub-sector registered a -1.3% growth rate.

Once again, the business of Department Store sub-sector did not improved. It recorded another around of negative growth at 8.9% during the last 3-month period of 2015. For the whole year, it recorded a negative growth rate of 7.6%. This was the worst performing retail sub-sector in 2015.

The Supermarket and Hypermarket sub-sector reported another period of decline with a negative growth of 1.7% for the fourth quarter of 2015. For the entire year, this retail sub-sector achieved a positive growth of 1.7%.

Fashion and Fashion Accessories sub-sector maintained its growth rate during the last quarter of 2015. During this period, it grew by 6.3% as compared to a year ago. For the entire year, it expanded by 5.6%. Surprisingly, this was the best performing retail sub-sector in 2015.

Pharmacy and Personal Care sub-sector reported a negative growth rate of 0.5% during the last 3-month period of 2015. For the whole year, its business increased by a mere 0.9%.

Similar to its previous quarter, the Other Specialty Stores subsector (including retailers selling photographic equipment with photo processing services, sports-related goods, children related goods, optical products, souvenirs and gifts, toys as well as restaurants) enjoyed a positive quarterly growth of 5.6%. For the whole year of 2015, this sub-sector expanded by 3.5% as compared to the same period a year ago.

NEXT 3 MONTHS’ FORECAST

Members of the retailers’ association are not optimistic on their retail businesses during the first quarter of 2016. For the first 3 months of this year, retail industry is expected to register a negative growth of 0.4% (Table 4), as compared to the same period a year ago.

The department store cum supermarket operators are expecting near zero growth for the first quarter of this year. During this period, they are estimating a 0.1% growth in their businesses.

Again, the department store operators are expecting their businesses to remain in the red with a negative growth rate of 7.3% for the first quarter of this year.

Despite three consecutive quarterly declines, supermarket and hypermarket operators are not expecting their businesses to improve. During the first 3 months of this year, this sub-sector will continue to suffer a negative growth of 0.9%.

Retailers in the fashion and fashion accessories sector expect their businesses to slow down with a positive growth of 4.7% during the first 3-month period of 2016.

Operators of pharmacy and personal care sector are not expecting strong recovery in their businesses in this new year. For the first quarter of 2016, their estimated growth rate is 0.8%.

After a strong recovery during the second half of 2015, the Other Specialty Stores sub-sector (including retailers selling photographic equipment with photo processing services, sportsrelated goods, children-related goods, optical products, souvenirs and gifts, toys as well as restaurants) are not hopeful to maintain their growth during the first quarter of 2016. During this latest quarter, they expect their business to decline by 0.1%, as compared to the same period a year ago.

THE YEAR 2016

Retail Group Malaysia maintains its forecast of 4.0% growth rate for Malaysia retail industry in 2016. Projected first quarter growth rate by MRA members at -0.4% is realistic with consideration of higher pre-GST sales during the same period a year ago as well as the weak Chinese New Year sales in February 2016.

Despite low fuel prices, the weak Malaysian currency has led to higher prices of raw materials, semi-finished goods and finished goods that are meant for final consumption by Malaysians. Prices of retail goods and services have been increasing gradually since the beginning of this year. This has further deteriorated the spending power of Malaysian consumers.

Recent higher retrenchment rate in the country from key economic sectors (including manufacturing, finance, insurance as well as oil and gas industries) may slow down the growth of Malaysia retail industry further.

The removal of subsidy on 25kg-bag of wheat flour from 1 March 2016 and the large increase of foreign worker levy for all key economic sectors (especially the agriculture, manufacturing and construction sectors) from 18 March 2016 may lead to another round of price increases of retail goods and services in the near future.

The 3% cut in employees’ EPF contribution from March 2016 is not expected to contribute significantly to overall retail sales in 2016.