PREAMBLE

Members of Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA) were interviewed on their retail sales performances for the entire year of 2021 and the first quarter of 2022.

LATEST RETAIL PERFORMANCE

For the fourth quarter of 2021, Malaysia retail industry recorded a promising growth rate of 26.5% in retail sales, as compared to the same period in 2020 (Table 1).

This latest quarterly result was above market expectation. Members of MRA and MRCA projected the fourth quarter growth rate at 18.3% in November 2021.

Started from October 1, spa, wellness centre and massage centre were allowed to re-open to fully vaccinated public.

Interstate travel ban was lifted on October 11, after 90% of the adult population was fully vaccinated. Domestic tourism brought more sales to retailers that were dependent on tourism spending. It benefited retail outlets located in not just Klang Valley, but also Langkawi, Georgetown, Ipoh, Genting Highlands, Cameron Highlands, Pangkor Island, Desaru Coast and Melaka.

By November 30, all states in Malaysia were in Phase 3 and 4 of National Recovery Plan (NRP). In addition, 96.9% of the adult population in Malaysia completed their covid-19 vaccination.

Retail sales climbed higher in December due to two major festivals- Christmas and Chinese New Year. Malaysian consumers resumed their festive shopping during this period. Malaysians returned to physical stores in both commercial centres and shopping centres located throughout the country.

By the last month of the year, shopping traffic returned in all major shopping malls located in Malaysia. Major shopping centres were packed with shoppers and diners.

Despite the robust growth during the last 3 months of the year, Malaysia retail industry contracted by 2.3% for the entire year of 2021 (Table 1).

The dismay sales performance during the first 9 months of 2021 dragged down the overall growth. The sales turnover generated during the last 3 months of the year was not sufficient to compensate for the heavy losses incurred earlier.

This is the second consecutive year the Malaysia retail industry recorded a negative growth rate. In 2020, the retail industry contracted by 16.3% as compared to the previous year.

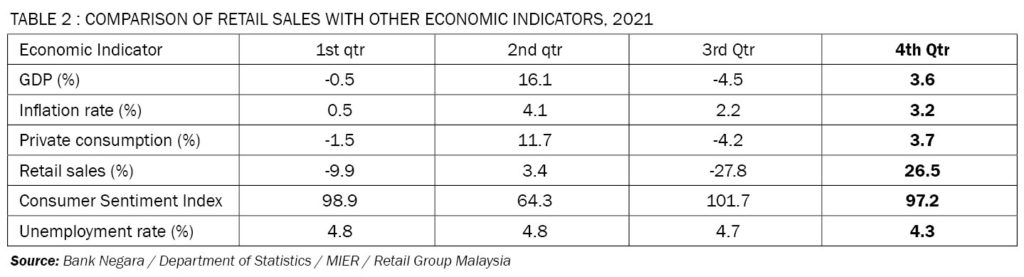

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

For the fourth quarter of 2021, Malaysia national economy recovered with a positive growth rate of 3.6% (Table 2, at constant prices), as compared to 26.5% for retail sales (at current prices).

The recovery was supported mainly by higher consumers’ spending as well as re-opening of all economic sectors.

The average inflation rate during the fourth quarter of 2021 rose to 3.2%. The higher prices during these 3 months were attributed mainly to rising costs of fuel and food prices.

Private consumption jumped by 3.7% during the fourth quarter of 2021. This turnaround was due to lifting of movement restrictions in stages since August.

After a brief recovery above the 100-point threshold level of optimism during the preceding quarter, the Consumer Sentiment Index (by MIER) dropped to 97.2 points for the last 3 months of 2021. Higher cost of living and lack of confidence in financial future led to the decline.

The re-opening of all economic sectors contributed to improved labour market. Unemployment rate during the fourth quarter of 2021 slowed down to 4.3%.

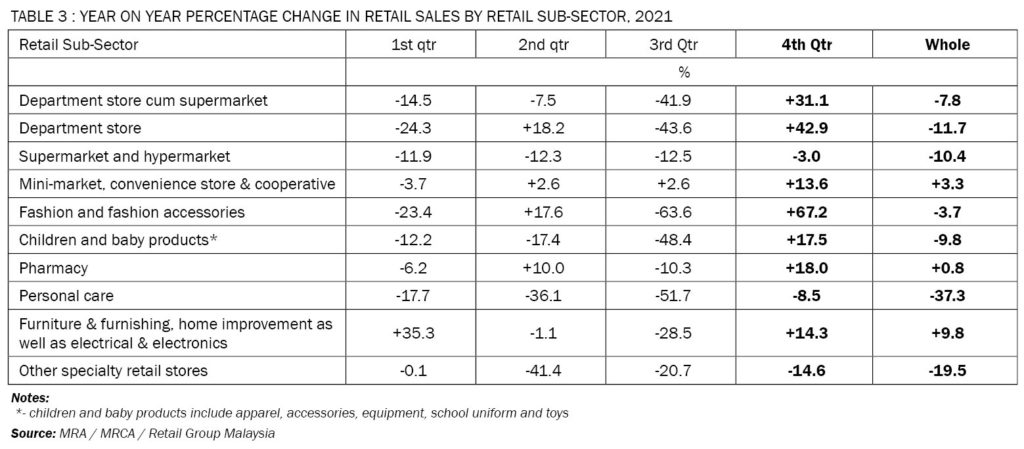

RETAIL SUB-SECTORS’ SALES COMPARISON

The sales performances of retail sub-sectors during the fourth quarter of 2021 were mixed. Many retail sub-sectors enjoyed strong recovery from a year ago. In the last quarter of 2020, Malaysia retail industry was suffering from third-wave covid-19 pandemic. The ban on interstate travel, the restriction on inter-district travel as well as working-from-home policy led to drastic drop in shopping traffic in malls, commercial centres and food & beverage outlets located throughout the country.

The sales turnover of Department Store cum Supermarket sub-sector grew faster with a growth rate of 31.1% during the fourth quarter of 2021, as compared to the same period a year ago. For the entire year, the business of this sub-sector contracted by 7.8%.

Similarly, the retail business of Department Store sub-sector expanded sharply during last 3-month period of the year. Its sales increased by 42.9% during the fourth quarter of 2021. For the year of 2021, its sales declined by 11.7%.

The Supermarket and Hypermarket sub-sector suffered another contraction with a growth rate of -3.0% during the fourth quarter of 2021. The growth rate of this sub-sector was -10.4% in 2021.

On the other hand, the Mini-Market, Convenience Store & Cooperative advanced further with a growth rate of 13.6% in retail sales during the fourth quarter of last year. For the whole year, it grew by 3.3%.

During the fourth quarter of 2021, the Fashion and Fashion Accessories sub-sector registered the best-ever quarterly growth of 67.2%, as compared to the same period a year ago. However, it suffered a negative growth rate of 3.7% for the year 2021.

The Children and Baby Products sub-sector enjoyed increase in retail sales by 17.5% during the last 3 months of the year. For the full year, the sales of this sub-sector dropped by 9.8%.

During the fourth quarter of last year, Pharmacy sub-sector reported a positive growth rate of 18.0%, as compared to the same period a year ago. This sub-sector managed to stay in the positive zone with a growth rate of 0.8% for the entire year.

On the other hand, the Personal Care sub-sector recorded another poor sales result with -8.5% in growth rate during the last 3-month period of the year. For year 2021, its sales sank by 37.3%. It was the worst performing retail sub-sector during the year.

The Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector managed to turn around with a growth rate of 14.3% during the fourth quarter of 2021. For the whole year, it grew by 9.8%.

The retail sales of Other Specialty Stores sub-sector (including photo shop, fitness equipment store, second-hand goods’ store, store retailing musical instrument and TV shopping) plunged by 14.6% during the fourth quarter of 2021. This sub-sector suffered a drop in business by 19.5% for the entire year.

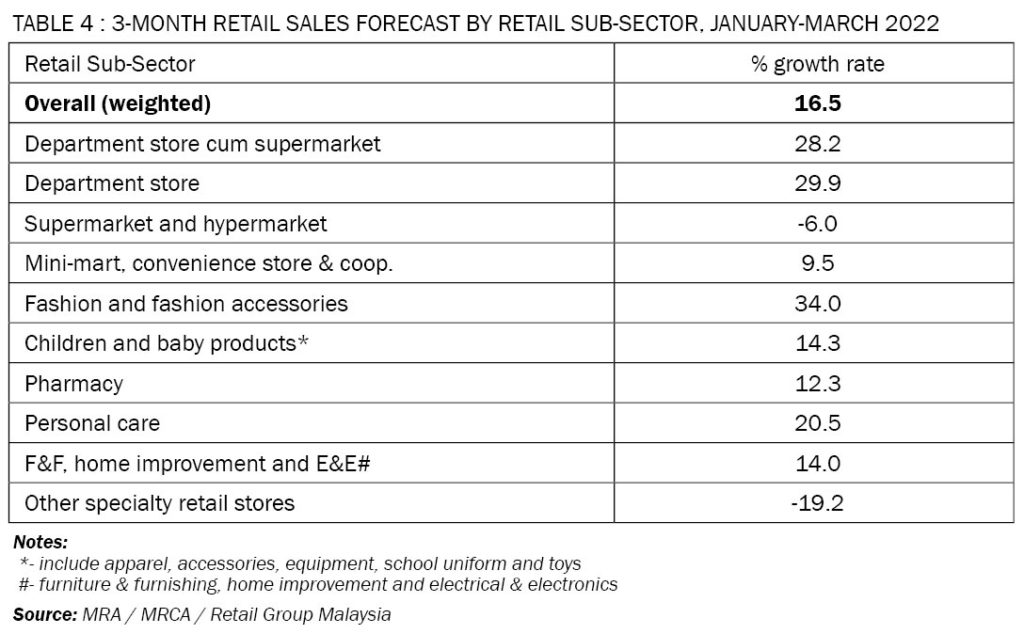

NEXT 3 MONTHS’ FORECAST

Members of the two retailers’ association project an average growth rate of 16.5% for the Malaysia retail industry during the first quarter of 2022 (Table 4).

The department store cum supermarket operators are expecting to maintain its recovery momentum with a growth rate of 28.2% for the first quarter of this year.

Also, the department store operators are predicting their businesses to expand with a growth rate of 29.9% for the first 3-month period of this year.

The supermarket and hypermarket sub-sector will see its business to decline by 6.0% for the first quarter of 2022.

Operators of mini-market, convenience store and cooperative are anticipating a growth rate of 9.5% during the first 3 months of this year.

Retailers in the fashion and fashion accessories sector are eyeing for another strong recovery with a growth rate of 34.0% during the first quarter of 2022, as compared to the same period a year ago. Once again, this retail sub-sector has the highest estimated growth rate for the next 3 months.

Retailers selling children and baby products are anticipating their businesses to expand with a growth rate of 14.3% during the first 3 months of this year.

Pharmacy operators are predicting their retail sales will climb by 12.3% during the first quarter of this year.

Retailers in the personal care sub-sector are hopeful that their businesses will turn around with a growth rate of 20.5% for the first quarter of 2022.

Operators of furniture & furnishing, home improvement as well as electrical & electronics are expecting to maintain their growth momentum with a growth rate of 14.0% during the first 3 months’ period of this year.

Once again, retailers in other specialty stores sub-sector (including photo shop, fitness equipment store, second-hand goods’ store, store retailing musical instrument as well as TV shopping) are less optimistic. They are foreseeing their businesses to slide by 19.2% during the next 3-month period. This will be the worst performer among the retail sub-sectors during this period.

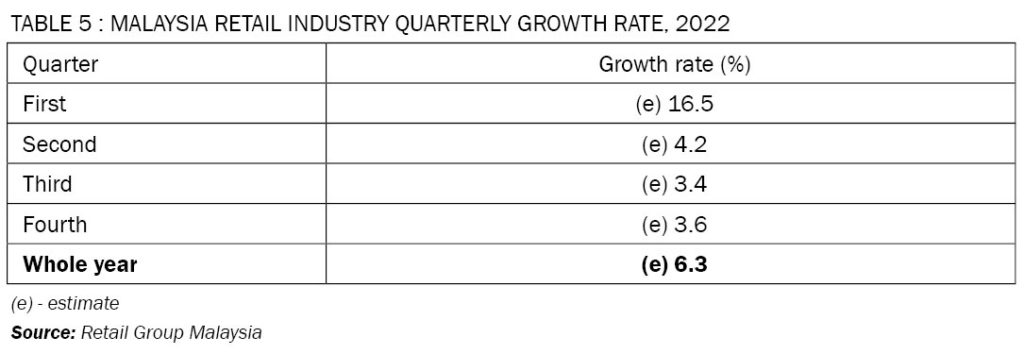

THE YEAR 2022

Retail Group Malaysia projects 6.3% growth rate in retail sale for 2022 (Table 5). This is an upward revision from its estimate made in November last year at 6.0%.

Malaysia retail industry looks forward to a strong recovery as it enters the third year of covid-19 pandemic. However, many challenges remain in this new year.

The omicron wave has disrupted the pace of recovery of retail industry in Malaysia. Based on the covid-19 development in recent weeks, the retail market prospect becomes uncertain again.

When daily positive cases climbed to historical high of 20,000 on February 11, Malaysian consumers start to wary on the high possibility of virus infection. Although major shopping malls in the country are still crowded on both weekdays and weekends, car traffic starts to drop gradually when daily cases maintain above 20,000.

The high daily positive cases and increased hospitalisation rates remain worrisome. This fourth-wave virus pandemic is haunting Malaysian retailers again.

The re-opening of international borders will likely to begin from second quarter of this year. The delay in international borders’ opening for all countries has affected foreign tourists’ arrival in Malaysia. The current entry requirements for foreign tourists into Malaysia are troublesome and it discourages leisure travellers from overseas countries. This has affect retail businesses that have been dependent on leisure travellers from other countries.

Prices of basic necessities and many consumers’ goods have risen since end of last year. Many foods & beverages outlets have increased their prices as well. Rising prices are expected to continue during the first half of 2022. In addition, oil prices have been rising in recent weeks. Higher cost of living will affect the purchasing power of Malaysian households in the new year. Likely interest rate hikes in near term will also have negative impact on buying power of Malaysian consumers.

The war in Ukraine will affect the supply chain of consumers’ goods worldwide. This surprised war will also lead to even higher oil prices and commodity prices.

For the first quarter of 2022, Malaysia retail industry is expected to enjoy a strong growth of 16.5% due to Chinese New Year festival and further relaxation of SOPs (Table 5).

Malaysia retail industry is anticipated to grow at 4.2% during the second quarter with contribution mainly from Hari Raya festival.

The third quarter growth rate is estimated at 3.4% due to a low base in the same period a year ago. By then, Malaysia should have begun its endemic phase of covid-19.

For the last quarter of 2022, Malaysia retail industry is hopeful of a 3.6% growth rate after a rosy performance a year ago.

FOOD & BEVERAGE SECTOR

During the last quarter of 2021, almost all food & beverage outlets had been allowed to open for business with normal operation hours. Diners returned to physical premises to enjoy their meals while observing social distancing rules.

With Malaysians allowed to visit families and friends as well as tourist attractions in all states of Malaysia, food & beverage outlets that were dependent on tourists were alive again.

During the same time, many office workers were allowed to return to their companies to work. Food and drink outlets located in city centres, business districts and major commercial areas welcomed office workers back for breakfast and lunch. Face-to-face business meetings also boosted sales of cafes and restaurants.

Food & Beverage Outlets (Cafe and Restaurant) managed to turn around with a growth rate of 30.8% during the fourth quarter of 2021, as compared to the same quarter a year ago (Table 6). For the entire year, it achieved a double-digit growth rate of 14.3%.

Similarly, Food & Beverage Outlets (Take-Away, Kiosk and Stall) enjoyed a positive growth rate of 28.6% during the fourth quarter of 2021, as compared to the same period one year ago. For the whole year of 2021, it recorded a moderate growth rate of 5.2% as compared to the previous year.

For the first quarter of 2022, food & beverage establishments will continue to enjoy strong sales similar to the preceding quarter.

The Chinese New Year festival encouraged social gathering among families and friends in large restaurants.

Interstate travel during the long festival holiday also boosted food outlets’ sales in tourist-dependent towns and resorts.

When Malaysia recorded high daily infection rates after the festival, some food & beverage outlets are experiencing slowing sales. Many individuals and families are starting to avoid public dining places.

Cafe and restaurant operators are foreseeing their businesses to climb by 31.2% (Table 6) during the first quarter of 2022, as compared to the same period last year.

On the other hand, food and beverage kiosk and stall operators are anticipating their businesses to increase slightly at 1.9% during the first quarter of 2022.

Footnote:

- This report is provided as a service to members of MRA, MRCA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.