Do they have a proper site selection process?

How do large multi-nationals decide where they spend their money on new sites? Whether they are in the oil industry, the QSR’s or any other very large chain of retail stores, I hope there is some logic in their site selection process.

Variability of information

The starting point for the decision of where to invest in retail should be available data. In an ideal situation, this would be a Census of population and housing, with data down to small areas such as every 100 households, traffic counts on the main roads, some form of pedestrian counts, business and employment information and probabaly the attractiveness of the surrounding /adjoining areas (often called the Generator score).

The facts are that across Asia (and the world), there are varying levels of data available to assist with these decisions. However I must say that many studies have found that a decision based on available facts and data WILL have a better result than one just made on gut feeling.

How do we make the correct decision?

I believe that basically every business looks at a new retail prospect in terms of will it make money for our business? If that is not the ultimate aim for a Corporation, then I am sure they will have trouble staying in business.

In an organisation there should be a CFO, or some other title under the CEO that is responsible for profitable new store development. Hopefully that role oversees a process of forecasting a Profit for the new store, and undertaking a reality check that this is not a piece of fiction.

I believe you can simplify a P & L down to 6 lines:

Sales (Gross Revenue)

Less

- Cost of Goods Sold

- Rent

- Labour

- Other

= Profit <or Loss>

Let us look at these inputs and decide which ones have the most effect, and which ones we can predict with some level of confidence?

1. Sales (Gross Revenue)

This is the most important as if this is out by a large factor, then the rest of the P & L becomes totally fictional. It amazes me how many companies spend a huge amount of time and effort on the other variables, and this is just left to be the “opinion” of some Development Manager based on “local knowledge”. This should be the input that has the MOST effort spent on it, and should be the result of a sales prediction model or process. I shall describe this further in the article

2. Cost of Goods Sold

If we already have many other stores open, we must have a very good feel as to what this is as a % of our Revenue. In my mind this is one we can predict very confidently.

3. Rent

That is exactly known by the time we lease the site, as it is a signed contract and agreement. If we are purchasing land and constructing, we again should have a very good idea of our location costs.

4. Labour

Like cost of goods sold, we should have a good idea of what it takes to run a store, with some flexibility if it over exceeds, and needs a small amount of additional labour – normally that we are happy to supply.

5. Other

Again a fairly well known amount we should be able to predict quite accurately. Costs of uniforms, phones, electricity, licences and permits – all items we should know from other sites we operate.

The result of all of the above is to make a simple prediction on the Profit <or Loss>.

I again come back to the one that has the major effect and therefore is the major risk – and that is the forecasting of the sales revenues. How can we make this more accurate?

Sales Forecasting

Forecasting Sales accurately should be proportional to the number of sites in our network.

If we only have 2 – 10 stores, we really can only look at them in a few measurable ways, look at their current sales and rate them, and then try to best explain to ourselves why the best stores are that way, and what is not working with our lower performing stores. Maybe by looking at some simple demographics – how many people live within 2 kms of the store, is it a high or low income area, or are we on a major or minor road, some learnings will be achieved.

If we have 10 – 40 stores, we normally look at doing a Check Chart, which is a tick the boxes type of method, with agreed ratings against each of the selected variables. The main point of this is so EVERY opportunity is evaluated in the same way, and the CEO of the firm starts to have confidence that the Development staff are all looking along the same agreed lines.

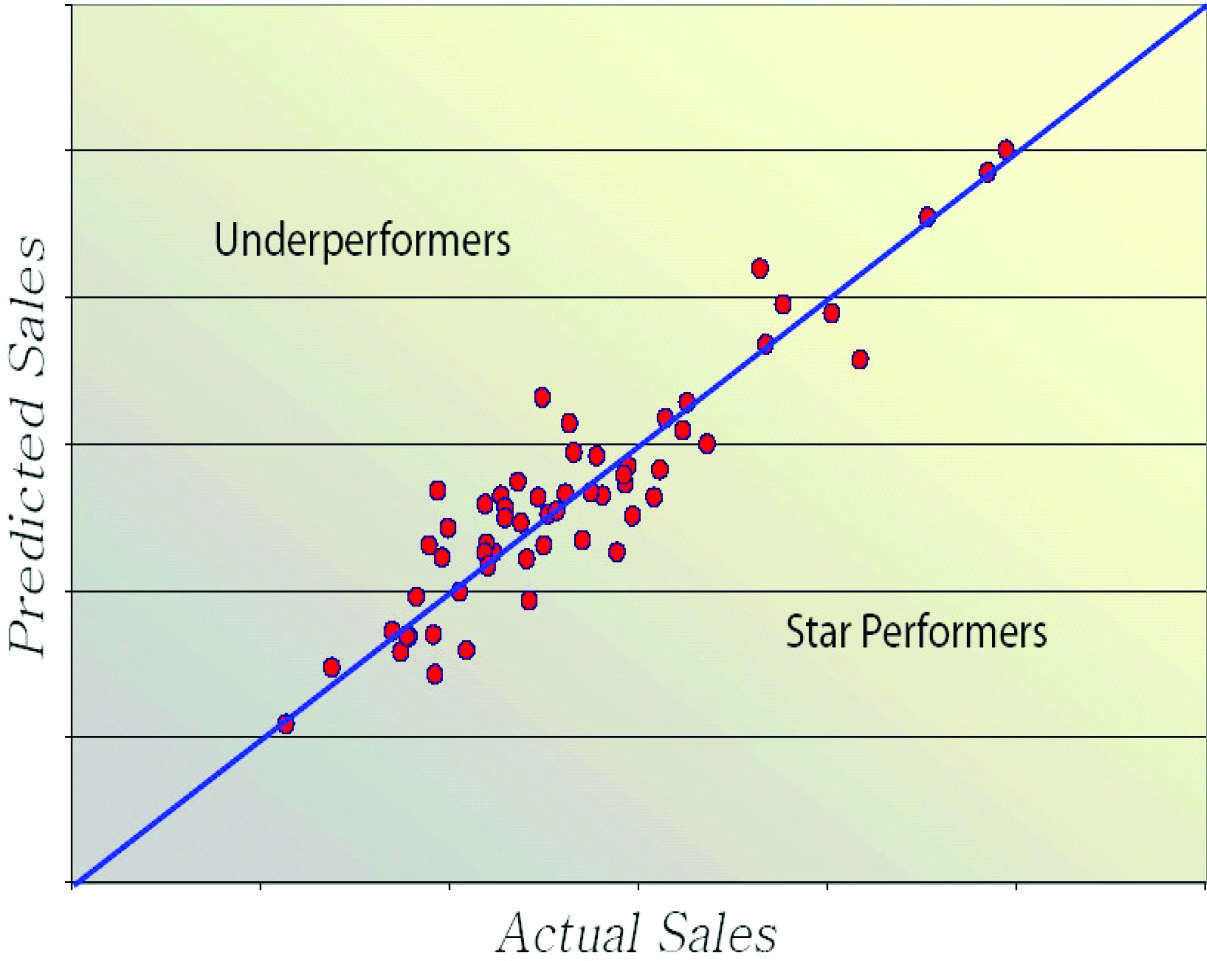

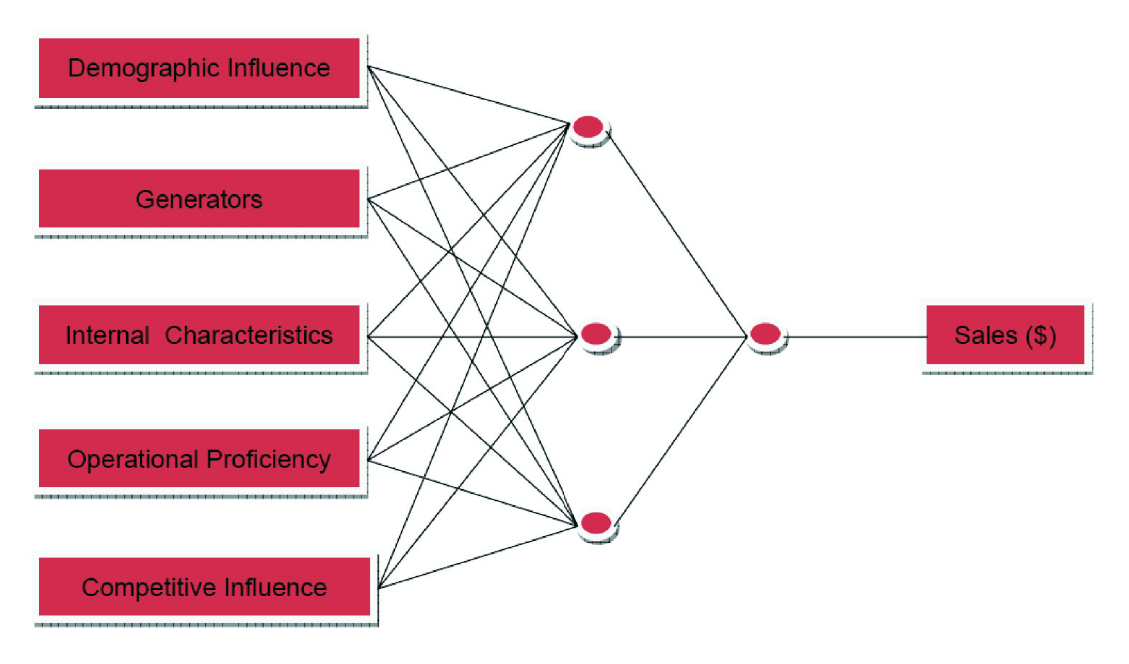

If we have 40 – 200 stores, we can now start to apply robust statistical processes. The most common is called Regression analysis, and is a fundamental statistical process, taught from high school statistics right thru to Post Graduate studies. Basically Regression modelling has a Dependent variable – ie the Sales revenue of the stores, and we are trying to best explain that looking at all the other independent variables we can measure. Ie if we know the sales of our existing stores, how much is that contributed to by factors like population, income, traffic, visibility, parking, and many, many more variables we can test against the sales. The variables that show the greatest effect on the sales are commonly called the Drivers.

It is often said that the best way to move forward is to understand the past. In site selection this can be interpreted as if I have 100 stores, surely I can learn what make the good ones good, and the poor ones poor. I should then be able to use those learnings to make the decision on where to put the 101st, 102ndetc etc.

If I have a really large network, we can look to very upmarket techniques such as neural networks and other advanced statistical tools – even sometimes referred to as artificial intelligence

An investment or an expense?

Please think of developing site selection tools and process as an Investment in the future, not a short term cost. Companies like McDonalds, Caltex and many others spend millions of dollars trying to get this as correct as they possibly can, and using it in their decision tree to make the GO / NO GO decision on a new store. And they normally get it right!

Ask yourself truthfully what is the cost of a store failure? Many companies blame all sorts of excuses, but in most cases it comes down to lack of process. In countries like Australia and the USA, bad site process can lead to legal action as you are sued by the irate / bankrupt ex Franchisee, and the court case can cost millions.

Summary

If you think that gut feeling is the right way to go, thanks for reading my article anyway. If you are using gut feeling, and can feel the pain and trauma I describe above, ask yourself should you invest in developing a proper site selection process?