Whether your business is big or small, you can and must perform some form of competitor intelligence and analysis if you want to create a sustainable competitive advantage over your competitors. The scope and scale of your analysis might differ. For example, if you are running a “mom-and-pop” corner shop, your competitors might be a similar shop around the corner and very much localised. If your business is in retailing, the sphere of your competitors should be much larger and targeted.

Whether your business is big or small, you can and must perform some form of competitor intelligence and analysis if you want to create a sustainable competitive advantage over your competitors. The scope and scale of your analysis might differ. For example, if you are running a “mom-and-pop” corner shop, your competitors might be a similar shop around the corner and very much localised. If your business is in retailing, the sphere of your competitors should be much larger and targeted.

With the current economic uncertainty, competitor analysis becomes increasingly important and cannot be ignored. Your competitors’ strategic actions might include price cuts, launching of new products and/or services, increase production and promotion to capture market share, and other internal cost control measures.

This article is a 2-part series presented by the author on the important role of competitor analysis in assisting businesses to increase sales revenue while reduce operating costs, using the COMPETE© Model. The components of this model are:

1. Competitors – identifying your unique opponents

2. Objectives – understand their objectives

3. Management – understanding the team within your competitors

4. Planning – the strategies employed in the past, and possible future strategies

5. Expected behaviours – include reactions to your strategies

6. Tried and tested – implementation of strategies

7. Expected outcomes – are they successful?

It is recommended that even owners or prospective owners of franchises should adopt some or all of these components, although franchisors are expected to render support to their franchisees in this area. In this issue, we will address the components of Competitors, Objectives and Management.

COMPETE

component 1: Competitors

Just look into trade directories, the Yellow Pages, or even scout around your neighbourhood. Competitors are everywhere. They may differ in size from you, but do they compete directly or indirectly with you? You must find out. There are 4 levels of competitors, as defined by Kotler (1997).

Brand competitors relate to direct competitors in your market niche that offer similar products or services that you do such as McDonald’s and Burger King in the fast food (hamburgers) industry.

Industry competitors relate to suppliers who produce similar goods as you but who are not necessarily of the same size or structure. One example might be Burger King and Malaysia’s Ramli Burgers. Another example is Singapore’s Ya Kun coffee shops and the Starbucks gourmet coffee chain.

Form competitors relate to suppliers whose products satisfy the same needs as yours, and yet they are positioned differently. For example, McDonald’s hamburgers and Subway’s sandwiches both satisfy the demand for fast food.

Generic competitors are other competitors who compete with you for the same limited disposable income of the general consumer public. By definition, almost anyone else in business can be deemed your competitors because if a consumer buys from them, then that consumer will have less to spend on your business.

Therefore, in choosing a suitable franchise, prospective franchisees can choose a franchise with the least competition or one that has a sufficiently unique and differentiated selling proposition. Beware of potential competitors that fit most of these characteristics as they can easily move into your niche especially if your profit margins remain high:

1. Serving the same or similar customers as your franchise

2. Having the same or cheaper distribution network

3. Using the same or more advanced technology as your franchise

4. Non-differentiated management expertise and skills

5. Similar geopolitical conditions

COMPETE

component 2: Objectives

Knowing what your competitors are trying to achieve will help you to determine what actions they will take and how you can counter them. Their objectives might vary, depending on certain factors including:

1. Management team make-up and control

If the majority shareholder is in control, it is likely that a longer term view will be taken compared to a professional manager, who is typically concerned with year end performance bonuses. However, if the shareholder is nearing retirement, the scenario might change altogether.

2. Time frame available

If the decision maker typically takes a short term view, it is unlikely that a high risk, longer investment payback period will interest him.

3. Strategic positioning in the market

If your competitors have ulterior motives for their presence in the market, it is likely that despite making losses in this market, they are unlikely to exit.

4. Extent of focus on the industry

If your competitor has not diversified into other industries, it is more likely that he will fight to the end to protect his market share.

COMPETE

component 3: Management

This pertains to the key management personnel. Your competitor is not the organisation but the people behind the organisation you are competing with for business. Knowing your competitors’ strength and weaknesses work to your advantage, especially if they cannot change their pricing and cost structure in the short term. Established models typically used to size up your opponent include portfolio analysis, position audit and the value chain analysis.

Portfolio Analysis

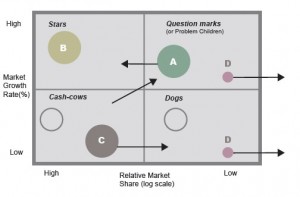

Portfolio analysis starts by first plotting your multiple businesses onto the quadrant that best represents its position. The size of the circle is mathematically derived. Without going into too much detail, it simply means that the bigger the circle, the greater is its importance to your business.

The Question Marks (or problem children) quadrant represents that part of your business that currently has low relative market share but has high potential for future growth. They are typically at the introductory stage of its product life cycle. There are 2 choices to make here: Either shut down/divest (D) and leave the market or invest (A) more to build it into a Star performer.

Investing to build involve strong negative cash flows. Provided your business have Cash Cows or external sources of funds to support, it will be difficult. Some of the strategies typically used include price reductions, acquisition of rivals, more promotional activities and possible product modification. Injection of funds from new investors will come in handy at this stage.

Having built your Question Marks into Stars, the strategy from here on is to elevate (B) into the high market share segment. Cash flows remain negative and your business should now focus on product or service differentiation and creation of branding. Growth will be sustained from a growing customer base.

In time, Stars will become Cash Cows. This is when a pattern of repeat or replacement purchases emerges. Cash flows will improve due to reduction in additional investment, brand loyalty will be strong and profitability will be at its highest. Typical strategies employed here is to harvest (C) or hold to support up and coming Question Marks.

The Dogs quadrant represents that part of your business that has low relative market share and low potential for further growth. They are usually former Cash Cows that management had stopped investing in or Question Marks that did not turn into Stars. The usual strategy here is to divest (D), unless it still produces positive contribution to profit, has low asset opportunity costs and its impact on the remaining part of your business is great.

It is also possible for a Dog to turn into a Cash-Dog. Examples include products or services with nostalgic value. For example, anything that brings back childhood memories of Singaporeans – kampung style living, ice balls with syrup, street stalls, etc – but with a slight commercial twist, are always welcomed.

Position Audit

According to the Chartered Institute of Management Accountants (CIMA) official terminology, a position audit is ‘part of the planning process which examines the current state of the entity in respect of tangible and intangible resources; products, brands and markets; operating (production, distribution, etc) systems; internal organisation; current results and returns to stockholders.’

Simply put, you must check your current position and do a stock take of your artillery and how they can be best used to neutralise your competitors. In this regard, the 9Ms Model is a comprehensive list of items necessary for consideration in a position audit.

1. Men

Essentially, this is your organisation’s human resource, including their skills, experience, morale and relative costs. Are you able to get the people to help you run your franchise? Do you have the necessary backing of your franchisor, banker, etc to fulfil the promises to your customers? Do your competitors have a stronger team? What can you do about it?

2. Management

What are the quality, expertise and experience of key management personnel? Do they possess vision and leadership? Can this be enhanced through executive workshops?

3. Money

Is your franchise profitable but lacking in cash? Does the organisation have a sufficient war chest to meet the threats of its competitors? Does it have access to external sources of funds?

4. Make-up

This relates to the organisational structure and culture of your organisation. Is your structure flexible, dynamic and nimble; yet able to harness the workforce to pursue congruent goals and objectives? Is the structure compatible with your corporate culture?

5. Machinery

This includes all physical assets of the business. Are they easily relocated, reconfigured, realised into cash, etc? Do you have sufficient room to manoeuvre?

6. Methods

This encompasses the standardized processes of your franchise, including the extent of outsourced non-core activities such as accounting and bookkeeping, HR payroll, etc functions. Capital or labour intensive production lines are also relevant considerations, as well as just-in-time production arrangements.

7. Markets

You must examine the relative quality of your products and your market position from your customers’ perspective. Is it under any threat from your competitors?

8. Materials

One consideration is to reduce the list of approved vendors who supply you with raw materials. This in effect enables the control of quality, the negotiation of bulk discounts and increase in customer service responsiveness. There is a limit to what you can do here if you need to adhere to your franchising agreement.

9. Management information

Are you getting timely and useful information for decision making? Does it include non-financial performance drivers e.g., sales by geographical location, trends, won-lost analysis? Remember, what gets measured gets done

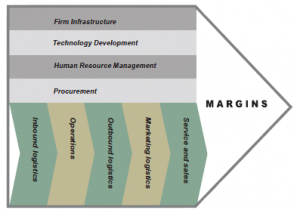

Value Chain Analysis

According to Porter (1985), the value chain is ‘a systematic way of examining all activities a firm performs and how they interact. It desegregates a firm into its strategically relevant activities in order to understand the behaviour of costs and the existing and potential sources of differentiation.

The Primary Activities are the 5 lower rung activities, which one would typically find in any businesses. Raw material inputs come in via inbound logistics, processed through operations, and stored and distributed via outbound logistics. In addition, marketing and sales creates the demand and channel to sell the products and finally follow up with good customer service after the sale.

The Support Activities are the 4 higher rung activities, which are again common in any businesses. They will provide support to the primary activities every step of the way, from inbound logistics to after sales service.

By focusing on each of the nine activities, management can identify how value is created.

Thus, improvements can be made by either adding more differentiation drivers or reducing cost drivers.

Examples of differentiation drivers

strategies include:

1. Backward or forward integration

2. Negotiate bulk discounts from suppliers

3. Charge premium pricing to customers

4. Produce customised products

Examples of cost drivers

strategies include:

1. Just-in-time manufacturing or delivery process

2. Reduce high stock holding costs

Your management accountant can assist by implementing Activity-Based Costing (ABC) whereby through strategic cost analysis, you can identify activities within your value chain, quantify the associated costs and identify opportunities for cost reduction or value enhancement.

To put it significantly but simply, if your business’ value chain adds more value to your customers than your competitors’, you will then gain sustainable competitive advantage over your competitors. The combination of supplier, producer and customer value chains in turn create the industry supply chain, and this requires the use of the business process re-engineering methodology; both of which are beyond the scope of this article.

The author does not expect business owners to utilise these tools without assistance from their management accountant. However, they must begin to think in this strategic pattern so that they will be able to ask insightful questions and make full use of their management accountant’s expertise.

In the next issue, we will address the remaining components of Planning, Expected behaviours, Targeted niche market and Expected outcomes.

Wayne Soo

CPA Singapore, CA (Malaysia), FCCA (UK), FCMA (UK), PNA (Australia) MSID, MBA (Manchester), Certified Fraud Examiner (CFE) USA Certified Management Consultant (CMC) Singapore.

Managing Partner

H W SOO & Co

Fiducia LLP

Certified Public Accountants

1 Goldhill Plaza

#03-35 Podium Block

Singapore 308899.

T: (65) 68468376

F: (65) 62346306

W: www.fiducia-llp.com

W: www.integrita.org

Email Wayne at

hw.soo@pacific.net.sg

Wayne Soo gained his more than 16 years of auditing, accounting management and financial experience initially with a Top 4 public accounting firm (both in Malaysia and Singapore). He founded his own firm in 2005, and has been an active audit, tax, business advisory and insolvency practitioner and trainer since then.

H W SOO & Co is on the audit panel of both the National Council of Social Service (NCSS) and Ministry of Community Development, Youth and Sports (MCYS). To date, Wayne has been intimately involved in providing assurance tax and advisory services to clients in many different industries. He holds 5 professional accounting qualifications and is a member of national accounting bodies in Singapore, Malaysia, UK and Australia.