PREAMBLE

Malaysia Retailers Association (MRA) and Retail Group Malaysia (RGM) have been working together for the last 23 years and have jointly published close to 100 retail reports.

For this new year, we have a new partner in our quarterly survey- Malaysia Retail Chain Association (MRCA).

Members of MRA and MRCA were interviewed on their retail sale performances for the entire year of 2020 and the first quarter of 2021.

LATEST RETAIL PERFORMANCE

For the fourth quarter of 2020, Malaysia retail industry reported a discouraging growth rate of -19.7%, as compared to the same period in 2019 (Table 1).

This latest quarterly result did not meet the earlier projection by Retail Group Malaysia in November 2020 at -18.2%. It was much lower than the average estimate made by MRA members (at -15.1%) end of last year.

The second Conditional Movement Control Order (CMCO) was implemented in Klang Valley (the largest retail market in Malaysia) from 14 October 2020. This movement restriction was later extended to all states of Malaysia (except Sarawak) until end of the year. Third-wave covid-19, restriction on interstate travel, restriction on inter district travel, working from home as well as delay in school opening led to significant reduction in shopping traffic in malls, commercial centres and foods & beverages outlets located throughout the country.

For the whole year of 2020, the retail sale growth rate was -16.3% as compared to the same period a year ago.

Last year, Malaysia retail industry recorded the worst performance since the Asian financial and economic crisis that took place 22 years ago. In 1998, retail sale in Malaysia dropped by 20%.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

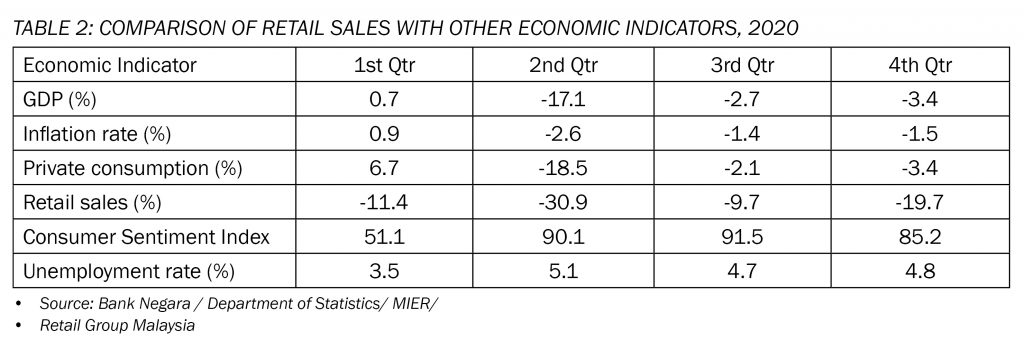

For the fourth quarter of 2020, Malaysia national economy contracted by 3.4% (Table 2, at constant prices), as compared to -19.7% for retail sales (at current prices). Except for manufacturing, all economic sectors recorded negative growth rates during this quarter. The reduction in economic activities was mainly attributed to the imposition of Conditional Movement Control Order (CMCO) on many states in the country since October.

The average inflation rate during the fourth quarter of 2020 declined by 1.5%. Food & Non-Alcoholic Beverages increased by an average of 1.4% during the quarter. On the other hand, cost of Transportation dropped by 9.9% on average and costs of Housing, Water, Electricity, Gas & Other Fuels decreased by 3.2% on average.

Private consumption contracted by 3.4% during the fourth quarter of 2020. Although online retail spending climbed higher, overall household spending slowed due to restricted movement in many states of Malaysia.

The Consumer Sentiment Index (by MIER) fell to 85.2 point during the last quarter of 2020. It had been below the 100-point confidence threshold for 9 consecutive quarters. Malaysians were very concerned on their future income and job prospects due to prolonged covid-19 pandemic.

Unemployment rate during the fourth quarter of 2020 worsened slightly to 4.8%.

RETAIL SUB-SECTORS’ SALES COMPARISON

During the fourth quarter of 2020, the performances of almost all retail sub-sectors remained poor (Table 3).

The business of Department Store cum Supermarket sub-sector declined sharply during the last 3 months of 2020, with a negative growth rate of 26.8%. For the entire year, it recorded a weak performance of -18.7%.

Department Store sub-sector continued to suffer from reduced revenue during the last quarter. Its business deteriorated with a double-digit negative growth rate of 44.7% during the fourth quarter.

For the whole year of 2020, the Department Store sub-sector achieved a growth rate of -38.3%. It was the worst retail performer among the retail sub-sectors.

Despite being able to open throughout the covid-19 pandemic, the Supermarket and Hypermarket sub-sector reported yet another poor result during the last quarter. For the fourth quarter of 2020, retail sale of this sub-sector declined by 19.6%. For the whole year, its sale dropped by 12.0%.

The Mini-Market, Convenience Store and Cooperative sub-sector was least affected as compared to many other retail sub-sectors. For the last quarter of 2020, it grew by 10.2%. For the entire year, its business expanded by 14.8%.

Fashion and Fashion Accessories sub-sector was the worst performer among the retail sub-sectors. As compared to the same quarter a year ago, fashion retailers reported a large decline in sales by 49.6%. For the entire year of 2020, this sub-sector achieved an unsatisfactory growth of -37.9%.

The Children and Baby Products sub-sector achieved a negative growth rate of 28.2% during the fourth quarter of last year. For the whole year, its business declined by 20.2%.

Pharmacy and Personal Care sub-sector stayed in the negative growth zone during this last quarter. During the last 3-month period of 2020, this sub-sector recorded a growth rate of -11.7%, as compared to the same period a year ago. For the year of 2020, this sub-sector suffered a decline in business by 11.8%.

The Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector performed well during the last quarter of 2020. It expanded by 11.7%, as compared to the same quarter a year ago. However, it managed to grow by merely 0.4% for the entire year of 2020.

The Other Specialty Stores sub-sector (including photo shop, second-hand goods’ store, fitness equipment store, optical store, shop selling baking ingredients, store retailing musical instruments, arts & crafts store as well as TV shopping channel) reported a negative growth rate of 5.2% during the fourth quarter of 2020. For the entire year, its growth rate was -11.7%.

Food & Beverage Outlets (Cafe and Restaurant) were allowed to open throughout the covid-19 pandemic. Nevertheless, its business still recorded a negative growth rate of 18.8% as compared to the same quarter a year ago. For the Year 2020, the business of this sub-sector reported a decline of 12.8% in terms of growth rate.

For Food & Beverage Outlets (Kiosk and Stall) that focused on take-away and delivery, its business did not fare well as well. For the last quarter of 2020, its sale dropped by 14.9%. For the entire year, its sales fell by 18.3%.

NEXT 3 MONTHS’ FORECAST

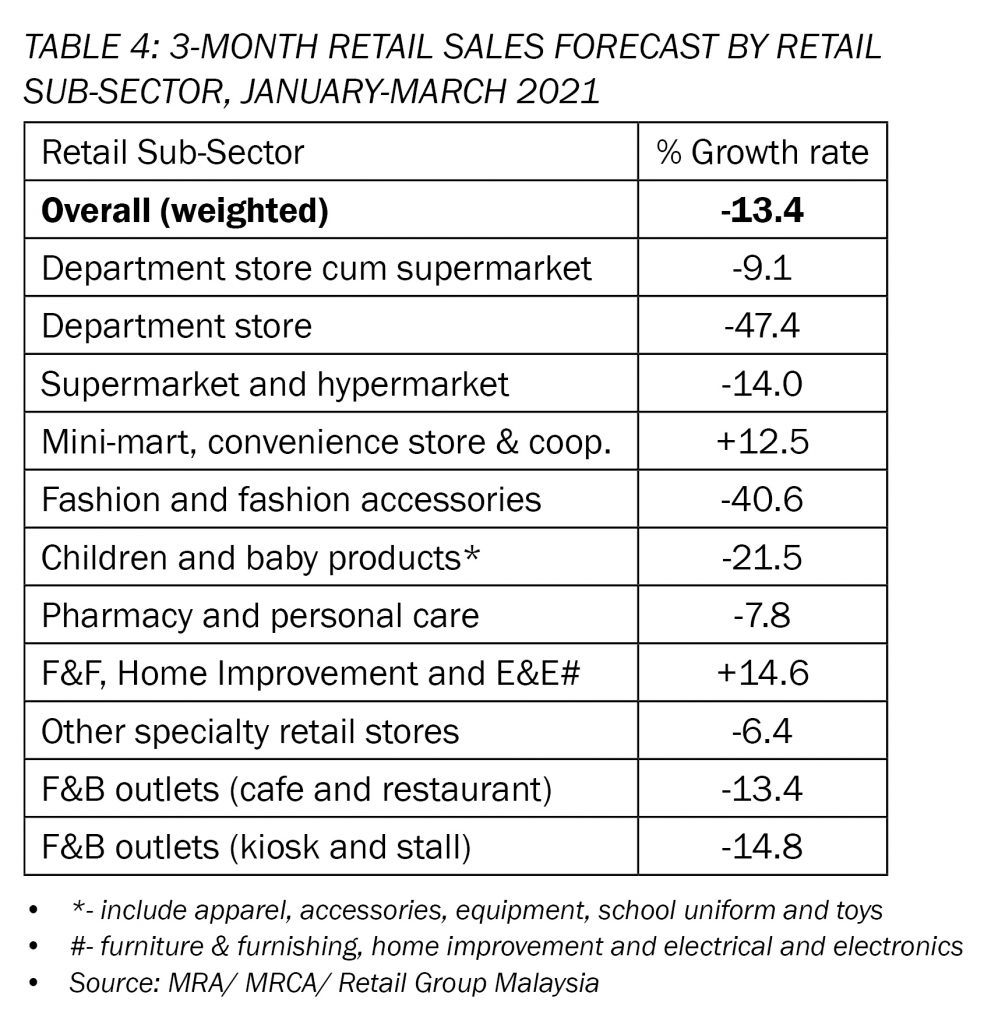

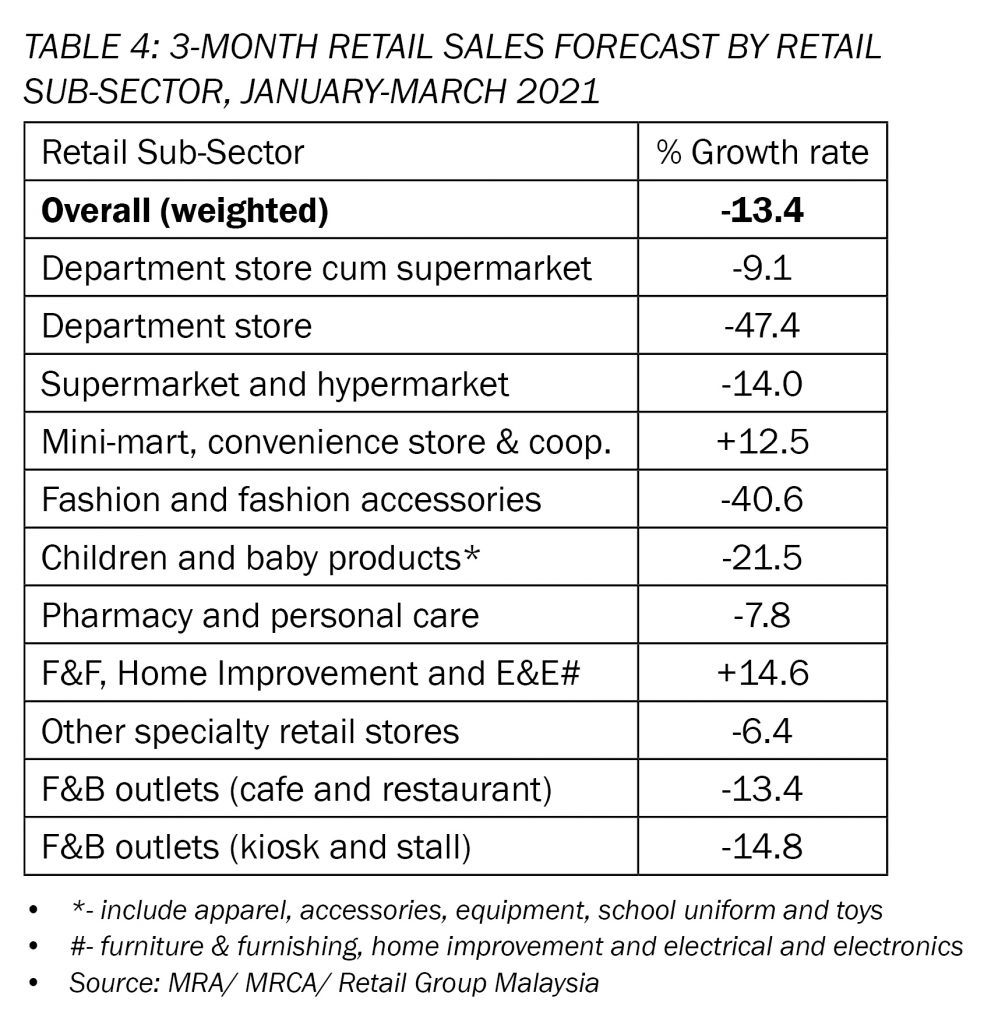

Members of the two retailers’ associations estimate an average growth rate of -13.4% during the first quarter of 2021 (Table 4). Movement Control Order (MCO) and CMCO in almost all states of Malaysia during the first 2 months of this year had affected almost all types of retail businesses.

The department store cum supermarket operators are hopeful of better performance during the first quarter of this year. For this quarter, it expects the business contraction to be smaller at -9.1%.

On the other hand, the department store operators do not anticipate a recovery so soon. This retail sub-sector is expected to suffer with another double-digit negative growth rate of 47.4% for the first 3-month period of this year.

Similarly, supermarket and hypermarket operators do not foresee their businesses to return to black during the first quarter of 2021. They anticipate their businesses to record another negative growth of 14.0% during this period.

Operators of Mini-Mart, Convenience Store and Cooperative are counting on their business to maintain at the same growth level as 2020. For the first quarter of 2021, they expect their business to grow by 12.5%.

The business of retailers in the Fashion and Fashion Accessories sub-sector is not expected to return to normal anytime soon. A poor growth rate of -40.6% is likely during the first quarter of 2021.

Retailers selling Children and Baby Products are doubtful of a recovery in business during the first 3 months of this year. They project their businesses to suffer a decline of 21.5% during the quarter.

Retailers in the Pharmacy and Personal Care sub-sector did not benefit as much during the recent MCO period. They are expecting their businesses to drop by 7.8% during the first quarter of 2021.

Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector is one of the two sub-sectors that expect to report positive growth rate during this quarter. For the first 3-month period, retail turnover in this sub-sector is expected to climb by 14.6% as compared to the same period a year ago.

Retailers in Other Specialty Stores sub-sector (including photo shop, second-hand goods’ store, fitness equipment store, optical store, shop selling baking ingredients, store retailing musical instruments, arts & crafts store as well as TV shopping channel) forecast their businesses to decline by 6.4% during the first 3-month period of 2021.

Cafe and restaurant operators are still not hopeful for the first 3 months of this year. They expect their food business to contract by 13.4% as compared to the same period last year.

Similarly, food and beverage kiosk and stall operators are not optimistic of their business performance during the first quarter of 2021. They expect sales to weaken by 14.8%.

THE YEAR 2021

In November last year, Retail Group Malaysia (RGM) projected a 4.9% growth rate in retail sale for 2021. However, this projection is no longer valid due to the re-implementation of MCO in the first 2 months of this year.

RGM has revised its growth rate projection downwards from 4.9% to 4.1% for the whole year of 2021 (Table 5).

This latest revision is also based on other factors of consideration.

More retail businesses will be allowed to open from March 2020. Nevertheless, movement restrictions continue to affect shopping traffic throughout the country.

Interstate travel ban is expected to be enforced for longer period of time and it has been affecting domestic tourism spending.

The return of foreign tourists will be slow and gradual. Travel bubbles with selected countries will likely to begin towards end of this year.

Vaccination on majority of the population will take a while. Thus, movement restrictions and social distancing measures will remain until end of this year.

For this entire year, consumers’ spending is not expected to recover back to 2019 level.

Footnote:

- This report is provided as a service to members of MRA, MRCA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.

Gd evening. Can l have the 2nd Qtr report.

Thank you