Preamble

Members of Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA) were interviewed on their retail sales performances for the second half of 2022.

This is the 25th anniversary of Malaysia Retail Industry Report. The first report was published in 1998 during the Asian financial and economic crisis.

Latest Retail Performance

For the third quarter of 2022, Malaysia retail industry recorded another impressive growth rate of 96.0% in retail sales, as compared to the same period in 2021 (Table 1).

This latest quarterly result was beyond market expectation. Members of MRA and MRCA projected the third quarter growth rate at 61.7% in September 2022. Retail Group Malaysia (RGM) estimated the quarterly growth rate at 50.0%.

During the same period a year ago, retail industry contracted by 27.8% (Table 1). Majority of retailers were forced to shut down during the first half period of third quarter 2021.

Enhanced Movement Control Order (EMCO) was enforced in large part of Selangor and selected locations in Kuala Lumpur from 3 July 2021 and ended on 16 July 2021. Retail businesses in the largest retail market of Malaysia were badly hit during this critical period.

From 16 August 2021, more retail businesses under National Recovery Plan (NRP) Phase 1 had been allowed to open. They included fashion shop, jewellery shop, electrical & electronics shop, furniture shop, sports shop, car accessories shop, hair salon, barber shop and car showroom.

When the government relaxed restrictions on number of passengers in a vehicle as well as the limit of travelling distance on 21 August 2021, shopping traffic in major shopping centres gradually returned.

Cinema, entertainment centre and beauty salon were allowed to open from 9 September 2021 for fully vaccinated individuals.

Recreational centres were allowed to resume their operations from 10 September 2021 for their fully vaccinated customers. Gyms were allowed to open from 18 September 2021 for their fully vaccinated members.

Klang Valley (Kuala Lumpur, Selangor and Putrajaya) was upgraded to NRP Phase 2 on 10 September 2021. More relaxations, including dine-in, were allowed for fully vaccinated individuals.

Effective 17 September 2021, more retail businesses were allowed to open for states under Phase 1 of NRP. They included personal care shop, toys store, antique shop, outdoor shop, tobacco shop, carpet shop, used items store, photography shop, souvenirs and craft shop, nursery as well as florist.

For the third quarter of this year, all retail businesses were operating with limited social distancing measures. Therefore, all retail businesses were able to operate at full capacity.

Shoppers from all over Malaysia returned to physical stores during the third quarter of 2022. Businesses of majority of retailers rebounded.

After 2 years of lockdown, many Malaysians travelled around the country for holidays, visited family members and relatives, as well as caught up with friends. Retail shops in tourist areas and small towns enjoyed brisk businesses.

For the first 9 months of this year, Malaysia retail industry expanded by 45.9% (Table 1), as compared to the same period in 2021.

The very high growth rates for the first 3 quarters of this year are unprecedented. It is unlikely to happen again unless another forced closure of retail shops took place.

Comparison Of Retail Sales With Other Economic Indicators

For the third quarter of 2022, Malaysia national economy grew by 14.2% (Table 2, at constant prices), as compared to 96.0% for retail sales (at current prices).

The strong performance during this quarter was due mainly to the low base effect a year ago. During the third quarter of last year, Malaysia economy contracted by 4.5%. The recovery of domestic demand also contributed to the higher growth rate.

The average inflation rate during the third quarter of 2022 jumped much higher to 4.5%. Once again, the increase surpassed the average inflation in Malaysia for the period 2011 to June 2022 at 2.0% only.

During the quarter, all main groups in the consumer price index recorded increases except for Communication which remained unchanged. Food & Non-Alcoholic Beverages reported the highest average increase (7.0%), followed by Restaurants & Hotels (6.4%). In addition, the average price of Transport rose 5.4% during the quarter.

Private consumption rose by 15.1% during the third quarter of 2022. Higher consumers’ spending was resulted from stable labour market and increased income.

During the third 3-month period, the Consumer Sentiment Index (by MIER) climbed to 98.4 points. However, it was still below the 100-point threshold level of optimism. Malaysian consumers remained cautious in spending due to uncertainty in the domestic economy.

Unemployment rate during the third quarter of 2022 slowed down slightly to 3.7%.

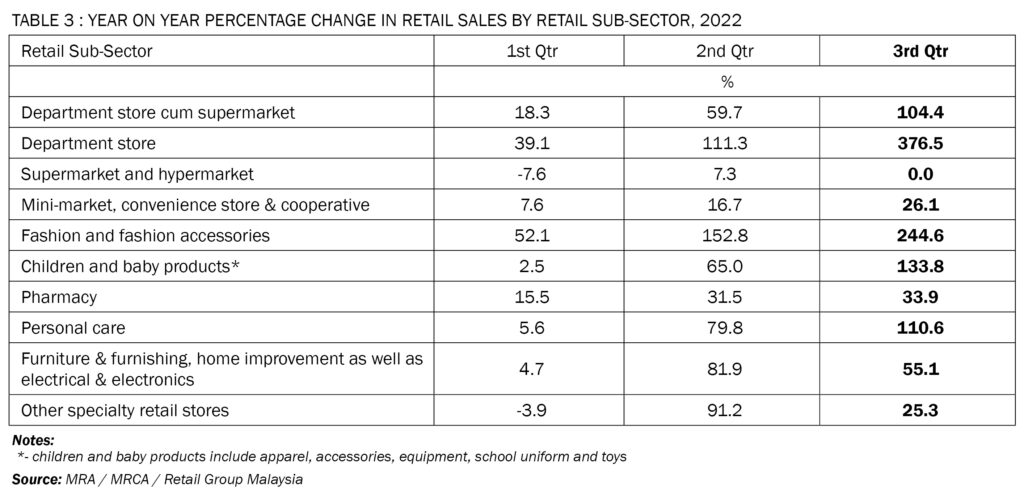

Retail Sub-Sectors’ Sales Comparison

Several retail sub-sectors enjoyed three-digit growth rates during the third quarter of 2022.

The sale turnover of Department Store cum Supermarket sub-sector rose sharply by 104.4% during the third quarter of 2022, as compared to the same period a year ago.

In addition, retail business of Department Store sub-sector leaped by 376.5% during third 3-month period of this year. This was the highest growth rate achieved among the retail sub-sectors for the quarter.

The business of Supermarket and Hypermarket sub-sector continued to normalise after Malaysians returned to their usual lifestyles. This sub-sector recorded a zero-growth rate during the third quarter of 2022.

On the other hand, the Mini-Market, Convenience Store & Cooperative enjoyed an encouraging growth rate of 26.1% in retail sales during the third quarter of this year.

During the third quarter of 2022, the business of Fashion and Fashion Accessories sub-sector surged by 244.6%, as compared to the same period a year ago. This was the second highest growth rate achieved among the retail sub-sectors for the quarter.

Similarly, the Children and Baby Products sub-sector enjoyed a robust growth by 133.8% during the third 3 months of this year.

During the third quarter of this year, Pharmacy sub-sector reported a promising growth rate of 33.9%, as compared to the same period a year ago.

The Personal Care sub-sector achieved another rosy retail sales with 110.6% in growth rate during the third 3-month period of this year.

The Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector reported an encouraging growth rate of 55.1% during the third quarter of 2022.

The Other Specialty Stores sub-sector (including photo shop, optical store, second-hand goods’ store, store retailing musical instrument, health equipment store, arts & craft store as well as direct selling firm) reported a moderate growth of 25.3% during the third quarter of 2022, as compared to the same period last year.

Next 3 Months’ Forecast

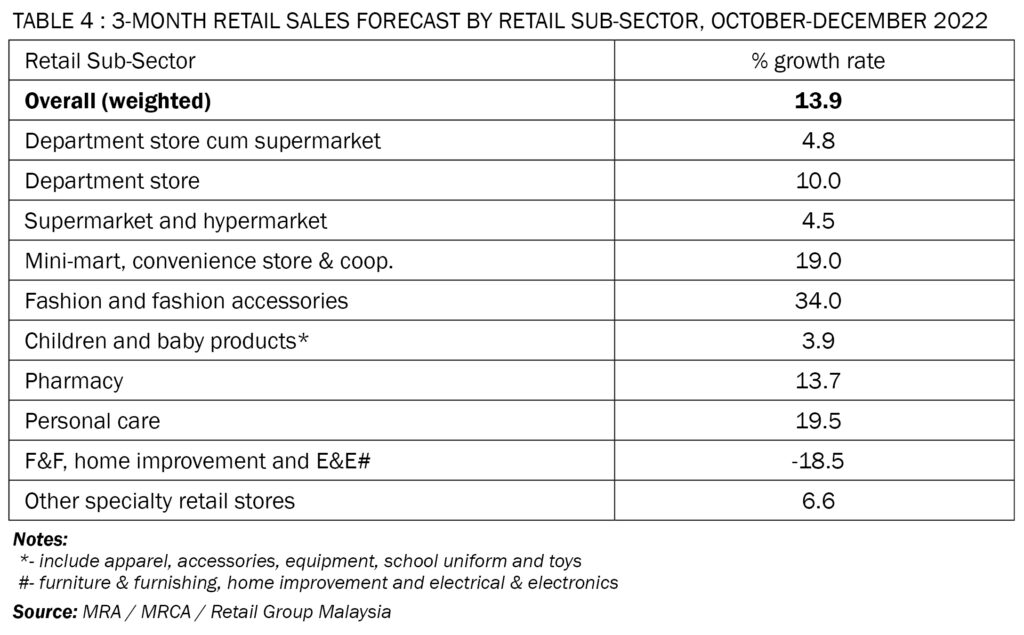

Members of the two retailers’ association project an average growth rate of 13.9% for the fourth quarter of 2022 (Table 4).

The department store cum supermarket operators are expecting their sales to normalise with a growth rate of 4.8% for the fourth quarter of this year.

Similarly, the department store operators are expecting their businesses to grow moderately at 10.0% for the last 3-month period of this year.

The supermarket and hypermarket sub-sector remains resilient with a growth rate of 4.5% for the fourth quarter of 2022.

Operators of mini-market, convenience store and cooperative are anticipating a sustainable growth rate of 19.0% during the fourth 3-month period of this year.

Retailers in the fashion and fashion accessories sector expect their businesses to climb by 34.0% during the fourth quarter of 2022, as compared to the same period a year ago. This retail sub-sector has the highest estimated growth rate for the next 3 months.

Retailers selling children and baby products are anticipating their businesses to ease with a growth rate of 3.9% during the last 3 months of this year.

Pharmacy operators are hopeful that their retail sales will continue to advance during the fourth quarter of this year with a growth rate of 13.7%.

Similarly, retailers in the personal care sub-sector are expecting their businesses to incline by 19.5% for the fourth quarter of 2022.

On the other hand, operators of furniture & furnishing, home improvement as well as electrical & electronics are expecting their business to contract by 18.5% during the fourth 3 months’ period of this year.

Retailers in other specialty stores sub-sector (including photo shop, optical store, second-hand goods’ store, store retailing musical instrument, health equipment store, arts & craft as well as direct selling firm) remain optimistic for this period. They expect their businesses to increase by 6.6% during the next 3-month period.

The Rest Of Year 2022

In September this year, Retail Group Malaysia (RGM) estimated 31.7% growth rate in retail sale for 2022. However, this projection needs to revise upwards again taking into consideration the better-than-expected growth during the third quarter as well as a revision of fourth quarter estimate.

RGM revises Malaysia annual retail industry growth rate for 2022 from 31.7% to 41.6% (Table 5).

On November 3, Bank Negara Malaysia decided to raise the Overnight Policy Rate (OPR) by 25 basis points to 2.75%. This is the fourth revision since May this year. Malaysian households need to brace for reduced spending power due to higher monthly loan repayment.

For the fourth quarter of 2022, the growth rate estimate has been revised upwards from 1.0% (estimated in September 2022) to 6.0%. This is lower than the forecast made by members of retailers’ associations (at 13.9%).

This lower revision takes into consideration the high base a year ago (at 26.5%) as well as the current challenges of Malaysia retail industry.

Nevertheless, retailers in Malaysia are hopeful that retail industry will continue to recover end of this year due to two upcoming major festivals- Christmas and Chinese New Year (end January 2023).

Year 2023

Retail Group Malaysia (RGM) forecasts 3.5% growth rate for Malaysia retail industry in 2023.

The biggest challenge for Malaysia retail industry in the new year is the rising cost of living.

Prices of basic necessities have been rising since beginning of this year. In addition, prices of many consumer goods have also increased. In fact, prices of many foods and consumer goods increased by double-digit within short period of time.

Higher retail prices lead to higher cost of living. This means lesser money to buy non-essential goods and services. The shopping behaviour and patterns of B40 and M40 households have changed in recent months. They cook more at home, delay buying high-value goods, pay greater attention to offers and discounts given by retailers, as well as make lesser trips to cafes and restaurants.

Various monetary incentives were announced during the Malaysia Budget 2023 in October this year. This will help to subsidise the higher prices of basic necessities for B40 and M40 households.

Next year, there will be reduction of personal income tax contribution by 2.0%. This will encourage Malaysian workers to channel this extra money to retail spending.

In Budget 2023, Malaysian government has allocated RM55 billion for subsidies, aids and incentives to alleviate cost of living. This will ensure costs of fuel, rice, flour, chicken, cooking oil and many other basic necessities remain affordable to Malaysians.

Nevertheless, the incentives and allocations may be changed because a new federal government was formed after the general election on 19 November 2022.

Food & Beverage Sector

As compared to non-essential retailers, food & beverage outlets stayed opened for take-away and food delivery during the lockdown periods in third quarter last year until 9 August 2021.

Started from 10 August 2021, dine-in was allowed for all foods & beverages outlets under National Recovery Plan (NRP) Phase 2 or higher states.

From 20 August 2021, dine-in was allowed for fully vaccinated individuals in states under Phase 1 of NRP. Fully vaccinated parents were allowed to take their children who are under 17-years-old to dine with them.

Beginning of 23 September 2021, foods & beverages establishments were allowed to open from 6am to 12am daily for all phases under the NRP.

Night entertainment outlets have been allowed to re-open since 15 May 2022 after more than 2 years of closures.

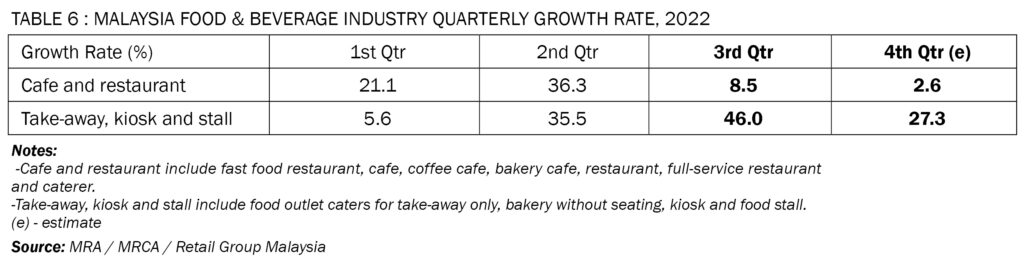

Food & Beverage Outlets (Cafe and Restaurant) recorded a positive growth rate of 8.5% during the third quarter of 2022, as compared to the same period a year ago (Table 6).

The businesses of Food & Beverage Outlets (Take-Away, Kiosk and Stall) jumped by 46.0% during the third quarter of 2022, as compared to the same period one year ago.

During the fourth quarter of this year, all F&B establishments have been able to operate as normal except with limited social distancing measures.

As food businesses return to pre-covid era, growth rates start to normalise as well.

At the same time, F&B operators are still struggling with higher raw material costs, increasing operation costs, rising rental cost and depleting profit margin during the fourth quarter of 2022.

Worst of all, many F&B outlets are still facing shortage of kitchen staff and servers.

Cafe and restaurant operators are foreseeing their businesses to increase by 2.6% (Table 6), as compared to the same period last year.

Similarly, food and beverage kiosk and stall operators are anticipating their businesses to grow by 27.3% during the fourth quarter of 2022.

Footnote:

- This report is provided as a service to members of MRA, MRCA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.