PREAMBLE

Members of the Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA) were interviewed on their retail sales performances for the second half of 2021.

LATEST RETAIL PERFORMANCE

For the third quarter of 2021, the Malaysia retail industry recorded a disappointing growth rate of -27.8% in retail sales, as compared to the same period in 2020 (Table 1).

This latest quarterly result was way below market expectation. Members of MRA and MRCA projected the third quarter growth rate at -15.1% in September 2021.

Retailers in Malaysia operated with strict social distancing measures under the Recovery Movement Control Order (RMCO) during the same quarter a year ago. On the other hand, most retailers were forced to shut down during the first half period of the third quarter of 2021.

Enhanced Movement Control Order (EMCO) was enforced in large part of Selangor and selected locations in Kuala Lumpur from 3 July 2021 and ended on 16 July 2021. Retail businesses in the largest retail market of Malaysia were badly hit during this critical period.

From 16 August 2021, more retail businesses under National Recovery Plan (NRP) Phase 1 had been allowed to open. They included fashion shop, jewellery shop, electrical & electronics shop, furniture shop, sports shop, car accessories shop, hair salon, barber shop and car showroom.

When the government relaxed restrictions on the number of passengers in a vehicle as well as the limit of travelling distance on 21 August 2021, shopping traffic in major shopping centres gradually returned.

Cinema, entertainment centre and beauty salon were allowed to open from 9 September 2021 for fully vaccinated individuals. However, most of these businesses only began opening to public a week or more later after finalising the complete SOPs with the relevant government departments.

Recreational centres were allowed to resume their operations from 10 September 2021 for their fully vaccinated customers. Gyms were allowed to open from 18 September 2021 for their fully vaccinated members.

Klang Valley (Kuala Lumpur, Selangor and Putrajaya) was upgraded to NRP Phase 2 on 10 September 2021. More relaxations, including dine-in, were allowed for fully vaccinated individuals.

Effective 17 September 2021, more retail businesses were allowed to open for states under Phase 1 of NRP. They included a personal care shop, toys store, antique shop, outdoor shop, tobacco shop, carpet shop, used items store, photography shop, souvenirs and craft shop, nursery as well as a florist.

For the first 9 months of this year, the retail sale growth rate contracted by 11.9%, as compared to the same period a year ago.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

For the third quarter of 2021, Malaysia national economy contracted by 4.5% (Table 2, at constant prices), as compared to -27.8% for retail sales (at current prices).

The national lockdowns under National Recovery Plan (NRP) affected economic activities during this quarter. All economic sectors registered contractions. The movement restrictions led to lower consumption and investment.

The average inflation rate during the third quarter of 2021 slowed down to 2.2%. Consumer Price Index (CPI) remained positive for the 8th consecutive month since February this year due to the lower base effect in 2020 as a result of the decline in fuel prices for private vehicles. During the third quarter, the average price of Transport rose 11.0%.

Private consumption dropped by 4.2% during the third quarter of 2021. This was a sharp contrast as compared to the double-digit expansion of 11.7% during the preceding quarter.

During the third 3-month period, the Consumer Sentiment Index (by MIER) jumped to 101.7 points. This was after 11 consecutive quarters below the 100-point threshold level of optimism. When almost all economic sectors had been allowed to open in stages since August, consumers’ outlook turned positive.

Unemployment rate during the third quarter of 2021 slowed down slightly to 4.7%.

RETAIL SUB-SECTORS’ SALES COMPARISON

The growth rates of retail sub-sectors during the third quarter of 2021 were similar to the second quarter of 2020 when the first Movement Control Order (MCO) in Malaysia was implemented.

The sale turnover of Department Store cum Supermarket sub-sector dipped sharply with a negative growth rate of 41.9% during the third quarter of 2021, as compared to the same period a year ago.

Similarly, retail business of Department Store sub-sector dived during third 3-month period of this year. It contracted by 43.6% during the third quarter of 2021.

Despite being allowed to open during the recent lockdowns, the Supermarket and Hypermarket sub-sector was still faced with declining retail sales with a negative growth rate of 12.5% during the third quarter of 2021.

On the other hand, the Mini-Market, Convenience Store & Cooperative enjoyed a small growth rate of 2.6% in retail sales during the third quarter of this year. This is the best performing retail sub-sector during the quarter.

During the third quarter of 2021, the Fashion and Fashion Accessories sub-sector registered the worst quarterly growth rate in terms of percentage. Its business declined by 63.6%, as compared to the third quarter of 2020.

The Children and Baby Products sub-sector suffered a drop in retail sales by 48.4% during the third 3 months of this year.

During the third quarter of this year, Pharmacy sub-sector reported a negative growth rate of 10.3%, as compared to the same period a year ago. This sub-sector was one of the few retail trades that remained open throughout this period.

The Personal Care sub-sector recorded another poor retail sale with -51.7% in growth rate during the third 3-month period of this year. Its physical stores stayed shut for almost the entire period of third quarter this year.

The Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector reported another decline in growth rate of 28.5% during the third quarter of 2021.

The Other Specialty Stores sub-sector (including photo shop, fitness equipment store, second-hand goods’ store as well as store retailing musical instrument) suffered another drop in retail sale by 20.7% during the third quarter of 2021, as compared to the same period last year.

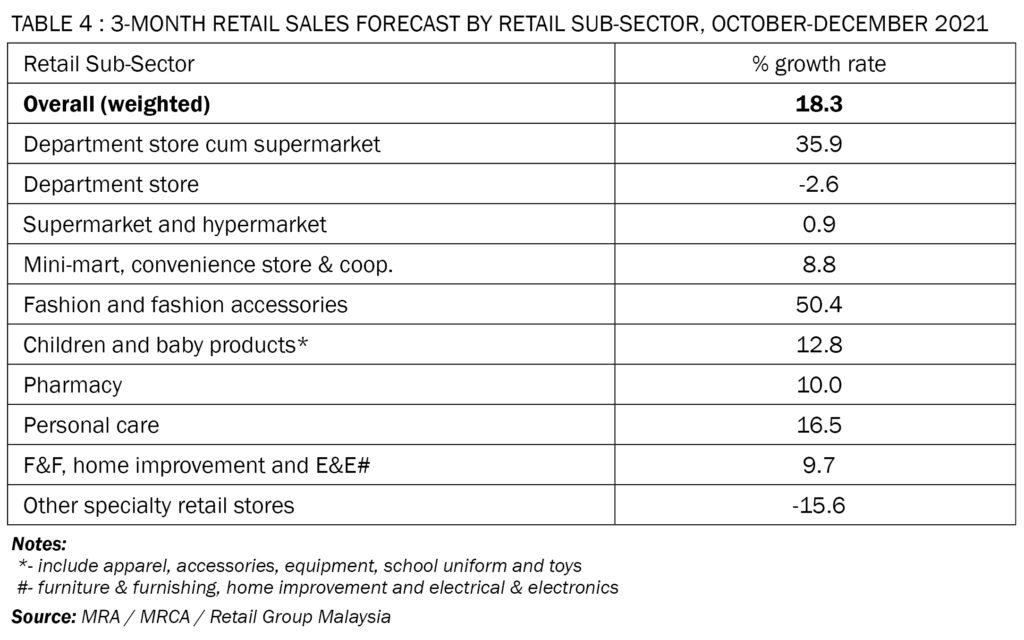

NEXT 3 MONTHS’ FORECAST

Members of the two retailers’ association project an average growth rate of 18.3% for the fourth quarter of 2021 (Table 4). Although all retail trades have been allowed to open for business during the last quarter of this year, not all retail sub-sectors expect strong recovery as compared to end of last year.

The department store cum supermarket operators are expecting their sales to rebound strongly with a growth rate of 35.9% for the fourth quarter of this year.

On the other hand, the department store operators are expecting their businesses to stay in the red zone with a negative growth rate of 2.6% for the last 3-month period of this year.

Although supermarket and hypermarket sub-sector remains the least affected among the retail sub-sectors during this difficult period, it will see only slight improvement in their businesses in the next 3 months. They expect to grow slightly at 0.9% for the fourth quarter of 2021.

Operators of mini-market, convenience store and cooperative are anticipating a moderate growth rate of 8.8% during the fourth 3-month period of this year.

Retailers in the fashion and fashion accessories sector expect their businesses to revive with a strong recovery of 50.4% in growth rate during the fourth quarter of 2021, as compared to the same period a year ago. This retail sub-sector has the highest estimated growth rate for the next 3 months.

Retailers selling children and baby products are anticipating their businesses to recover with a moderate growth rate of 12.8% during the last 3 months of this year.

Pharmacy operators are also hopeful that their retail sales will turn around during the fourth quarter of this year with a growth rate of 10.0%.

Similarly, retailers in the personal care sub-sector are expecting their businesses to expand by 16.5% for the fourth quarter of 2021.

Operators of furniture & furnishing, home improvement as well as electrical & electronics are expecting to report an average growth at 9.7% during the fourth 3 months’ period of this year.

Retailers in other specialty stores sub-sector (including photo shop, fitness equipment store, second-hand goods’ store as well as store retailing musical instrument) are less optimistic for this period. They expect their businesses to slide by 15.6% during the next 3-month period. This will be the worst performer among the retail sub-sectors during this period.

THE REST OF YEAR 2021

In September this year, Retail Group Malaysia (RGM) estimated 0.8% growth rate in retail sale for 2021. However, this projection needs to revise downwards again taking into consideration the worse-than-expected growth during the third quarter as well as a revision of fourth quarter estimate.

RGM revises Malaysia annual retail industry growth rate for 2021 from 0.8% to 0.5% (Table 5).

Started from 1 October 2021, spa, wellness centre and massage centre have been allowed to re-open to fully vaccinated public.

Interstate travel ban was lifted on 11 October 2021 after 90% of the adult population had been fully vaccinated. Domestic tourism has brought more sales to retailers that have been depending on tourism spending.

As at 30 November 2021, all states in Malaysia were in Phase 3 and 4 of NRP. In addition, 96.9% of the adult population in Malaysia had completed their covid-19 vaccination.

RGM expects retail industry to gain momentum on its recovery by the end of this year. For the fourth quarter of 2021, the growth rate estimate has been revised upwards from 12.7% (estimated in September 2021) to 18.3%.

Retailers are hopeful that retail sales will climb higher in December this year due to two upcoming major festivals- Christmas and Chinese New Year.

YEAR 2022

Retail Group Malaysia projects 6.0% growth rate in retail sale for 2022. Malaysia retail industry looks forward to a recovery from the covid-19 pandemic of almost 2 years. However, few challenges remain.

The high daily positive cases remain worrisome. A potential fourth-wave pandemic is haunting Malaysian retailers. Malaysian non-essential retailers cannot afford another forced closures of physical stores.

A new covid variant discovered recently is now spreading rapidly across the world. This will affect the economic recoveries around the world as well as in Malaysia.

Malaysian government has decided to delay the country’s transition into the endemic phase due to uncertainty of the virus pandemic.

Foreign tourists’ arrival may be affected due to the current virus development. This will affect retail businesses that have been dependent on leisure travellers.

The recent spike in prices of many consumers’ goods may continue next year. Rising cost of living will affect the purchasing power of Malaysian households in 2022.

FOOD & BEVERAGE SECTOR

Commencing from 1 June 2021, Full Movement Control Order (FMCO) was introduced that required majority of Malaysians to stay home. National Recovery Plan (NRP) was implemented from 15 June 2021. Similar to FMCO, dine-in was not allowed.

Started from 10 August 2021, dine-in was allowed for all foods & beverages outlets under NRP Phase 2 or higher states.

From 20 August 2021, dine-in was allowed for fully vaccinated individuals in states under Phase 1 of NRP. Fully vaccinated parents were allowed to take their children who are under 17-years-old to dine with them.

Beginning of 23 September 2021, foods & beverages establishments were allowed to open from 6am to 12am daily for all phases under the NRP.

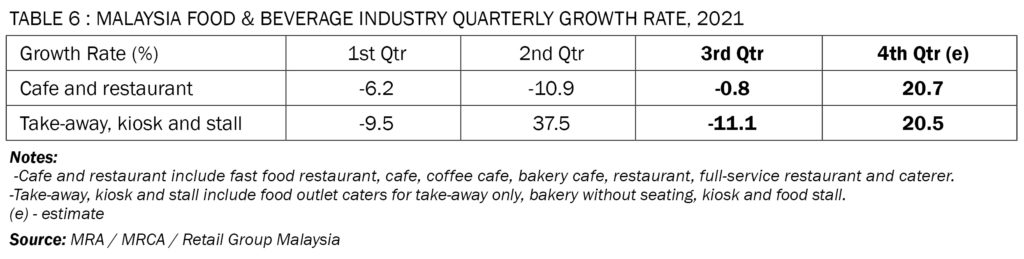

Food & Beverage Outlets (Cafe and Restaurant) recorded a negative growth rate of 0.8% during the third quarter of 2021, as compared to the same quarter a year ago (Table 6).

The businesses of Food & Beverage Outlets (Take-Away, Kiosk and Stall) plummeted by 11.1% during the third quarter of 2021, as compared to the same period one year ago.

During the fourth quarter of this year, almost F&B establishments have been able to operate as normal except with social distancing measures.

With Malaysians allow to visit families and friends as well as tourist attractions in other states of Malaysia, F&B outlets that have been dependent on tourists are alive again.

Since middle of September, many workers have been allowed to return to their companies to work. Food and drink outlets located in city centres, business districts and major commercial areas welcome office workers back for breakfast and lunch. Face-to-face business meetings also boost sales of cafes and restaurants.

Cafe and restaurant operators are foreseeing their businesses to recover for the last 3 months of this year. They expect their food business to climb by 20.7% (Table 6), as compared to the same period last year.

Similarly, food and beverage kiosk and stall operators are anticipating their businesses to grow by 20.5% during the fourth quarter of 2021.

Footnote:

- This report is provided as a service to members of MRA, MRCA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.