Preamble

Members of Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA) were interviewed on their retail sales performances for the first half-year of 2023.

This is the 26th anniversary of Malaysia Retail Industry Report. The first report was published in 1998 during the Asian financial and economic crisis.

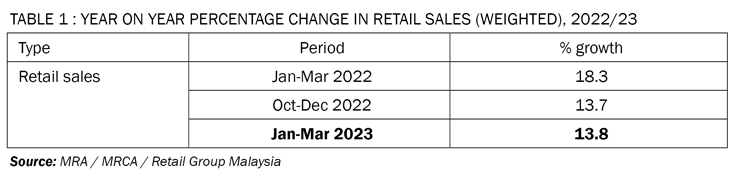

Latest Retail Performance

For the first quarter of 2023, Malaysia retail industry recorded a better-than-expected growth rate of 13.8% in retail sales, as compared to the same period in 2022 (Table 1).

This latest quarterly result was 50% higher than the estimate made by members of MRA and MRCA at 9.2% in March 2023.

The strong growth rate was driven by Chinese New Year celebration in January as well as the 1-month school holiday in February and March.

The covid-19 pandemic in 2020 and 2021 affected school terms and school holidays. The traditional year-end school holiday in December 2022 was moved to second and third month of this year. The first day of school in 2023 began on March 20, instead of January 2 in the previous years before covid-19.

The Malaysia academic calendar will only return to normal in Year 2026.

The recovery of Malaysia retail industry had been sustainable since end of 2021.

Shopping traffic had returned in all major shopping malls and commercial centres located across the country. Shoppers had returned to physical stores. Malaysian consumers were buying non-essential goods as well as dining in good quality cafes and restaurants.

Purchasing power of most Malaysians dropped due to higher cost of living, Malaysian consumers always seek out discounts and offers by retailers and F&B operators. They tried to maintain the quality of their lives.

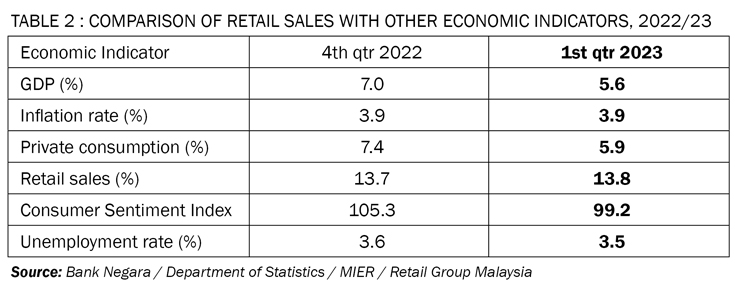

Comparison of Retail Sales with Other Economic Indicators

For the first quarter of 2023, Malaysia national economy recorded a positive growth rate of 5.6% (Table 2, at constant prices), as compared to 13.8% for retail sales (at current prices).

The latest economic growth rate was supported by sustainable household spending, higher number of private and government investment projects, improved labour market condition as well as higher tourism spending.

The services and construction sectors were the main drivers of growth. Services sector grew by 7.3%, which construction sector expanded by 7.4%.

The average inflation rate during the first quarter of 2023 remained high at 3.9%.

During the month of March, food prices remained at high level. Prices of Restaurants & Hotels increased by 7.2%. Prices of Food & Non-Alcoholic Beverages rose by 6.9%.

82.4% of the monitored items in March recorded increases in prices. 9.3% of them rose more than 10%, while the remaining 90.7% increased prices by less than 10%.

Private consumption climbed by 5.9% during the first quarter of 2023 due to stable labour market condition, higher minimum wage and government cash handouts.

During the first quarter of 2023, the Consumer Sentiment Index (by MIER) fell below the 100-point threshold level of optimism at 99.2 points. Concerns on rising cost of living and future job prospect led to the decline.

Unemployment rate during the first quarter of 2023 improved marginally with a slower growth rate of 3.5%.

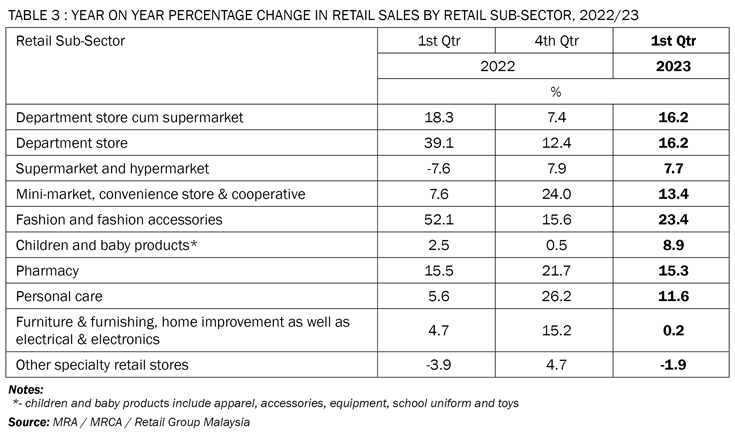

Retail Sub-Sectors’ Sales Comparison

The sales performances of retail sub-sectors during the first quarter of 2023 (Table 3) were mixed.

Department Store cum Supermarket sub-sector recorded a sustainable strong growth rate of 16.2% during the first quarter of 2023, as compared to the same period a year ago.

Similarly, Department Store sub-sector maintained its recovery momentum with a growth rate of 16.2% during first 3-month period of this year.

After a slowdown in business a year ago, the Supermarket and Hypermarket sub-sector witnessed its sales returned to pre- covid-19 level. Its business expanded by 7.7% during the first quarter of 2023.

The Mini-Market, Convenience Store & Cooperative sub-sector continued to deliver promising growth rate at 13.4% during the first quarter of this year.

During the first quarter of 2023, the growth rate of Fashion and Fashion Accessories sub-sector swelled by 23.4%. This was the highest growth rate achieved among the retail sub-sectors during this quarter.

The Children and Baby Products sub-sector regained its recovery momentum with 8.9% growth during the first 3 months of this year.

During the first quarter of this year, Pharmacy sub-sector managed to maintain its growth momentum with an increment of 15.3%, as compared to the same quarter a year ago.

Likewise, the Personal Care sub-sector enjoyed a double-digit growth rate of 11.6% during the first 3-month period of this year.

The growth rate of Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector softened to 0.2% during the first quarter of 2023.

Similar to a year ago, the Other Specialty Stores sub-sector (including photo shop, fitness equipment store, store retailing musical instrument, optical store, health equipment store, second-hand goods’ store, sporting goods’ store, arts & crafts store, gifts store as well as online shopping platform) slipped into a negative zone with a growth rate of -1.9% during the first quarter of 2023, as compared to the same period last year.

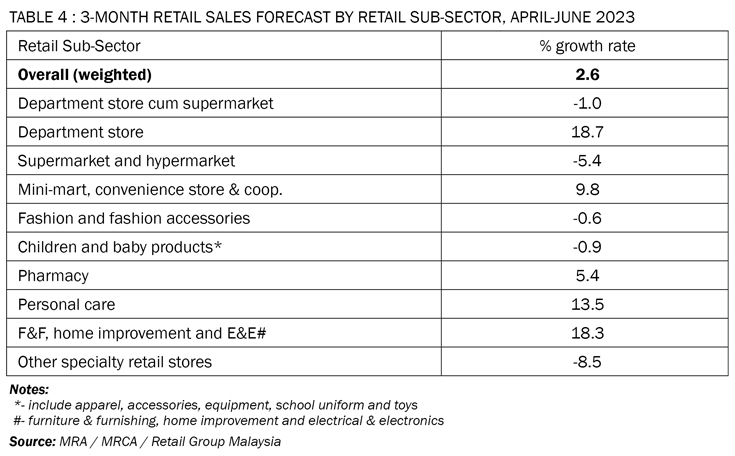

Next 3 Months’ Forecast

After an unprecedented surge in retail sales of 62.5% a year ago, members of the two retailers’ associations project an average growth rate of 2.6% during the second quarter of 2023 (Table 4).

Many retail sub-sectors are expected to undergo a normalisation path after a strong recovery in 2022.

The department store cum supermarket operators are expecting its business to ease with a growth rate of -1.0% for the second quarter of this year.

On the other hand, the department store operators are expecting its businesses to grow at 18.7% for the second 3-month period of this year. This sub-sector has the most optimistic retail sales forecast for the quarter.

The supermarket and hypermarket operators expect its sales to contract by 5.4% in growth rate for the second quarter of 2023.

The operators of mini-market, convenience store and cooperative are anticipating its growth rate to soften to 9.8% during the second 3 months of this year.

After an impressive recovery in 2022, retailers in the fashion and fashion accessories sector expect its businesses to normalise with -0.6% in growth rate during the second quarter of 2023, as compared to the same period a year ago.

Similarly, retailers selling children and baby products predict its retail growth rate to weaken at -0.9% during the second 3- month period of this year.

Pharmacy operators anticipate its retail sales during the second quarter of this year to grow at a slower pace at 5.4%.

Retailers in the personal care sub-sector are upbeat of its businesses during the second quarter of 2023 with a growth rate of 13.5%.

Operators of furniture & furnishing, home improvement as well as electrical & electronics are foreseeing its business to thrive with a growth rate of 18.3% during the second 3 months of this year.

Retailers in other specialty stores sub-sector (including photo shop, fitness equipment store, store retailing musical instrument, optical store, health equipment store, second-hand goods’ store, sporting goods’ store, arts & crafts store, gifts store as well as online shopping platform) do not expect its businesses to climb back to the positive zone during the next 3- month period of 2023. For the quarter, retailers in this sub- sector are projecting a negative growth rate of 8.5%.

The Year 2022

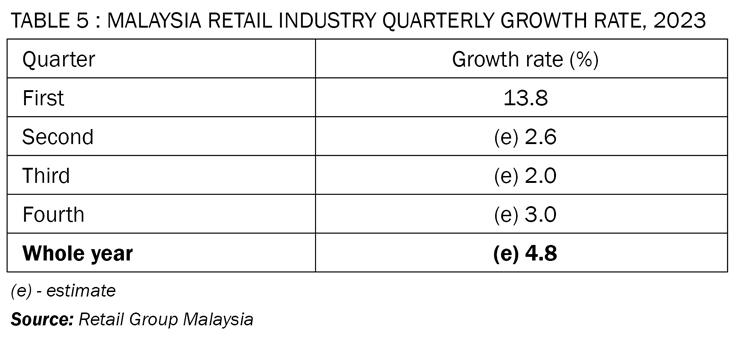

In March this year, Retail Group Malaysia (RGM) estimated a 4.0% growth rate in retail sale for 2023. RGM has revised upwards Malaysia annual retail industry growth rate for 2023 from 4.0% to 4.8% (Table 5) due to the higher-than-expected retail result during the first quarter of this year.

Shopping traffic has returned to pre-covid level. Shoppers are visiting physical outlets and dining in their favourite cafes and restaurants. However, Malaysia retail industry is still facing several major challenges for the second half of this year.

Although monthly inflation rate has eased during the last few months, the price increments of many basic necessities and consumer goods are still higher than pre-lockdown.

Malaysia inflation rate rose by 3.3% in April. The increase was driven by Restaurant & Hotels (6.6%), Food & Non-Alcoholic Beverages (6.3%), Furnishing, Household Equipment & Routine Household Maintenance (3.0%) as well as Transport (2.3%).

Food & Non-Alcoholic Beverages contributes 29.5% of the total Consumer Price Index (CPI) weight. For the month of April, 84.3% of the food items recorded price increases.

The average inflation rate for the first 4 months of this year increased by 3.5%, as compared to 2.2% for the same period a year ago. Majority of Malaysians are still burden by the higher cost of living.

On May 3, Bank Negara Malaysia raised the Overnight Policy Rate (OPR) by 25 basis points to 3.0%. This was the fifth revision since May last year. Higher interest rate has led to Malaysia house owners to pay higher monthly instalment. Higher interest rate encourages Malaysians to put more money in the banks.

Various cash handouts, vouchers and e-wallet incentives were announced during the retabled Budget 2023 in February. This has helped to reduce the financial burden of B40 and M40.

Reduction of income tax by 2.0% for employees in the M40 group has sustained retail spending in recent months.

On the other hand, Higher income tax (1.5% more) on the T40 has no major impact on the purchasing power of this group of people.

Luxury tax will be introduced from second half of this year. Nevertheless, the tax rate, the list of goods to be taxed, the area of coverage and date of implementation have not been finalised.

Malaysia retail industry is anticipated to grow by 2.6% during the second quarter of 2023 with contribution mainly from Hari Raya festival. This is in strong contrast to the 62.5% growth rate a year ago. This is also slightly lower than the 2.8% projection made in March this year.

The third quarter growth rate is estimated at 2.0% only due to a high base in the same period a year ago. During the third quarter of 2022, retail industry growth rate jumped by 96.0%.

For the last quarter of 2023, Malaysia retail industry is hopeful of a 3.0% growth rate after a rosy performance a year ago.

Food & Beverage Sector

During the first quarter of 2023, food & beverage establishments continued to enjoy sustainable sales with outlets operating at full capacity.

The Chinese New Year festival encouraged social gathering among families and friends in all kinds of F&B outlets.

Interstate travel during the long Chinese New Year and school holidays boosted food outlets’ sales in tourist-dependent towns and resorts. Furthermore, higher foreign tourist arrival contributed to better sales.

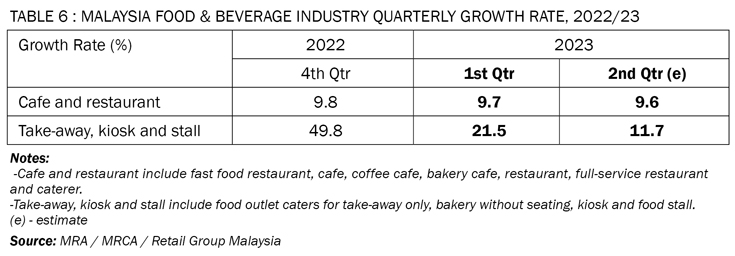

Food & Beverage Outlets (Cafe and Restaurant) recorded a sustainable growth rate of 9.7% during the first quarter of 2023, as compared to the same quarter a year ago (Table 6).

On the other hand, the sales of Food & Beverage Outlets (Take- Away, Kiosk and Stall) eased to 21.5% in growth rate during the first quarter of 2023, as compared to the same period one year ago.

Higher food prices led to increasing costs for F&B operators in Malaysia. Since beginning of last year, many of F&B outlets (including hawker stalls, coffee shops, cafes, restaurants and national chain outlets) have raised their prices.

For many F&B outlets, the lack of staff has affected their sales and operation hours. Shortage of staff applies to both Malaysians and foreign workers.

Cafe and restaurant operators are hopeful that their business will retain its growth momentum for the next quarter. Its sales should grow by 9.6% during the second 3 months of this year, as compared to the same period a year ago.

Whereas, food and beverage kiosk and stall operators are projecting its business growth to slow down further at 11.7% during the second quarter of 2023.

Footnote:

- This report is provided as a service to members of MRA, MRCA and the retail It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.