PREAMBLE

Members of Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA) were interviewed on their retail sales performances for the first half-year of 2022.

This is the 25th anniversary of Malaysia Retail Industry Report. The first report was published in 1998 during the Asian financial and economic crisis.

LATEST RETAIL PERFORMANCE

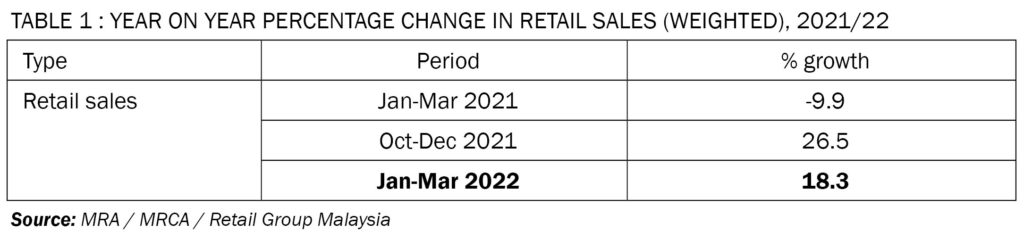

For the first quarter of 2022, Malaysia retail industry recorded a promising growth rate of 18.3% in retail sales, as compared to the same period in 2021 (Table 1).

This latest quarterly result was higher than the estimate made by members of MRA and MRCA at 16.5% in March 2022.

So far, the retail recovery had been sustainable since end of last year.

Shopping traffic had returned in all major shopping malls and commercial centres located across the country. Shoppers had returned to physical stores to enjoy what they missed during the long period of lockdowns last year.

In addition, the Chinese New Year festival (started in early January and ended in middle of February) contributed to stronger sales for Malaysian retailers. Non-Chinese in Malaysia took advantage of this festival to enjoy shopping and travelling as well. Domestic tourism had contributed to higher retail sales.

Despite daily positive cases reached 10,000 on February 6 this year, major shopping centres were still crowded on both weekdays and weekends. When daily positive cases climbed to 20,000 from February 11, shoppers could still be seen everywhere.

On February 23 this year, daily positive cases spiked above 30,000. Surprisingly, major shopping malls were still crowded. Although passenger car drivers did not need to struggle to find parking lots, the decline in shopping traffic was not significant.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

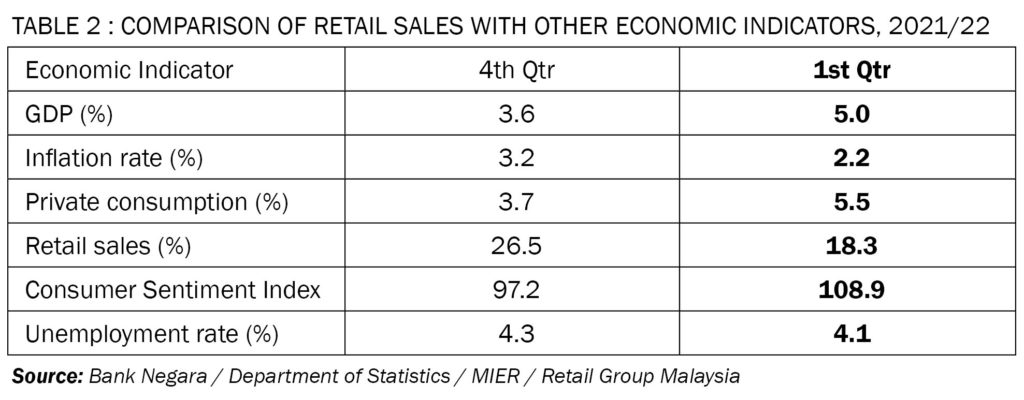

For the first quarter of 2022, Malaysia national economy recorded a better-than-expected growth rate of 5.0% (Table 2, at constant prices), as compared to 18.3% for retail sales (at current prices).

The services and manufacturing sectors were the main drivers of growth. Further easing of movement restrictions led to higher domestic demand. Global recovery contributed to higher demand for E&E products.

The average inflation rate during the first quarter of 2022 moderated at 2.2%.

Malaysian consumers were faced with increasing prices of basic necessities including vegetables, meat and fish. Food prices had been rising during the first 3 months of the year due to supply shortages, climate changes as well as higher animal feed prices.

The prices of Food & Non-Alcoholic Beverages group rose an average of 3.8% during the quarter. This group contributed 29.5% of Consumer Price Index (CPI) weight.

Private consumption expanded by 5.5% during the first quarter of 2022 due to increased retail spending, re-opening of recreational facilities and higher domestic tourism.

During the first quarter, the Consumer Sentiment Index (by MIER) rose above the 100-point threshold level of optimism at 108.9 points. Better employment and higher take-home pays contributed to improved sentiment.

Unemployment rate during the first quarter of 2022 improved with a slower growth rate of 4.1%.

RETAIL SUB-SECTORS’ SALES COMPARISON

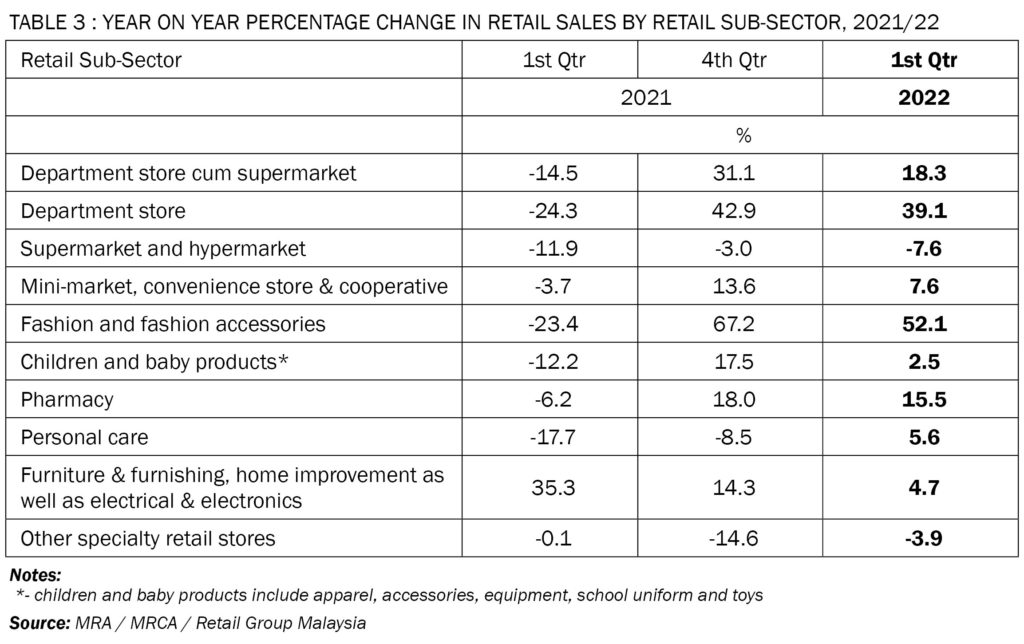

Not all retail sub-sectors achieved robust sales during the first quarter of 2022 (Table 3). Selected retail sub-sectors that enjoyed good performances during lockdowns were now returning to pre-pandemic sales levels.

Department Store cum Supermarket sub-sector recorded a positive growth rate of 18.3% during the first quarter of 2022, as compared to the same period a year ago.

Department Store sub-sector maintained its recovery momentum with a growth rate of 39.1% during first 3-month period of this year.

The Supermarket and Hypermarket sub-sector witnessed its business returning to pre covid-19 level. Its business slowed down with a growth rate of -7.6% during the first quarter of 2022. It was the worst performing retail sub-sector during the quarter.

On the other hand, the Mini-Market, Convenience Store & Cooperative were able to maintain its retail sale growth with 7.6% during the quarter.

During the first quarter of 2022, the Fashion and Fashion Accessories sub-sector recorded a high 52.1% in growth rate. This is the highest growth rate achieved among the retail sub-sectors during this quarter.

The Children and Baby Products sub-sector recorded a slower increment in retail sales with 2.5% in growth rate during the first 3 months of this year.

During the first quarter of this year, Pharmacy sub-sector managed to maintain its recovery momentum with a growth rate of 15.5%, as compared to the same quarter a year ago.

After a year of declining sales, the Personal Care sub-sector resumed its growth with 5.6% during the first 3-month period of this year.

The Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector enjoyed a moderate growth rate of 4.7% during the first quarter of 2022.

The Other Specialty Stores sub-sector (including photo shop, fitness equipment store, store retailing musical instrument, optical store, second-hand goods’ store, arts & crafts store as well as direct selling firm) suffered a decline in business with a growth rate of -3.9% during the first quarter of 2022, as compared to the same period last year.

NEXT 3 MONTHS’ FORECAST

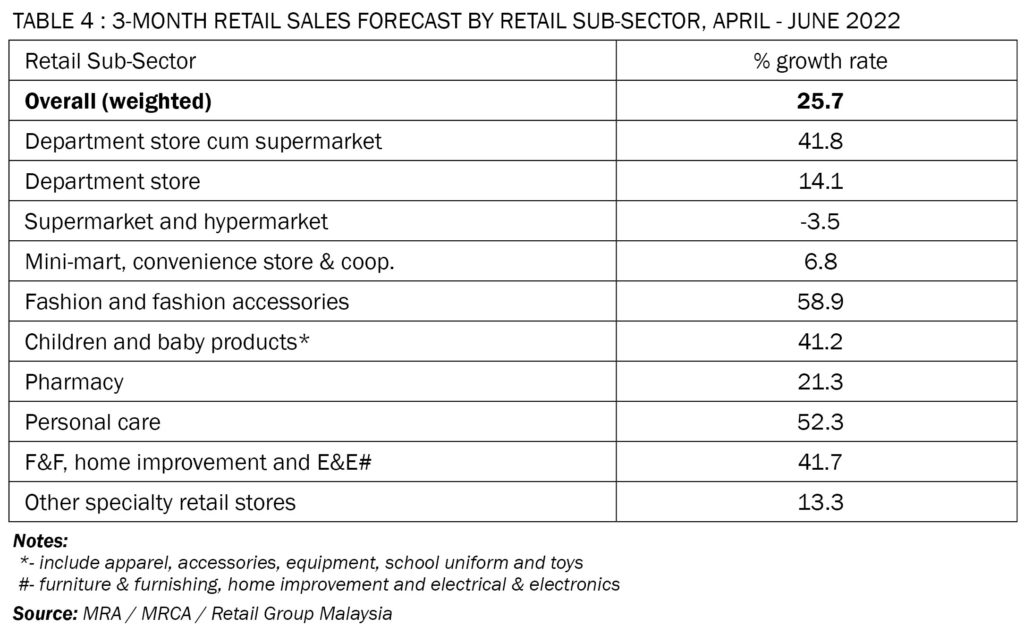

Most members of the two retailers’ associations are upbeat on retail sales for the next 3 months’ period. It projects an average growth rate of 25.7% during the second quarter of 2022 (Table 4).

The department store cum supermarket operators are expecting to maintain its pace of recovery with a growth rate of 41.8% for the second quarter of this year.

Whereas, the department store operators are expecting their businesses to moderate at 14.1% for the second 3-month period of this year.

The supermarket and hypermarket operators expect to remain in the red zone with a -3.5% growth rate for the second quarter of 2022. This is the lowest estimate among the retail sub-sectors during this quarter.

On the other hand, operators of mini-market, convenience store and cooperative are anticipating a sustainable growth rate of 6.8%.

Retailers in the fashion and fashion accessories sector expect their businesses continue to thrive with 58.9% in growth rate during the second quarter of 2022, as compared to the same period a year ago. This is the highest estimated growth rate among the retail sub-sectors during this quarter.

Retailers selling children and baby products are optimistic of a strong recovery at 41.2% in terms of growth rate during the second 3-month period of this year.

Pharmacy operators are hopeful of their retail sales during the second quarter of this year with a better performance at 21.3% in growth rate.

Retailers in the personal care sub-sector are expecting their businesses to leap by 52.3% in growth rate for the second quarter of 2022.

Operators of furniture & furnishing, home improvement as well as electrical & electronics are expecting its sales to jump by 41.7% during the second 3 months of this year.

After a dismay performance in 2021, retailers in other specialty stores sub-sector (including photo shop, fitness equipment store, store retailing musical instrument, optical store, second-hand goods’ store, arts & crafts store as well as direct selling firm) are expecting their businesses to climb back to the positive zone. During the next 3-month period of 2022, they are projecting a growth rate of 13.3%.

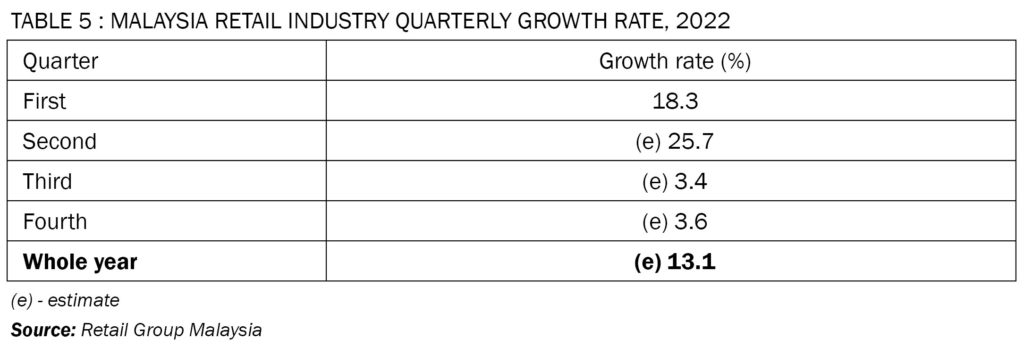

THE YEAR 2022

In March this year, Retail Group Malaysia (RGM) estimated a 6.3% growth rate in retail sale for 2022. RGM has revised upwards Malaysia annual retail industry growth rate for 2022 from 6.3% to 13.1% (Table 5) due to the expected strong retail result during the second quarter of this year.

1 April 2022 was the beginning of the transition to the endemic phase for Malaysia. A new set of SOPs was introduced by the Malaysian government. There is no more restriction of operation hours of retail shops. Interstate travel is allowed regardless of vaccination status. Full capacity allows for events and activities involved large groups. Operations of workplaces allow in full capacity. Fully vaccinated overseas visitors allow to enter Malaysia without quarantine. Unboosted Sinovac recipients and senior citizens are allowed to enter shopping centres as well as dine in eateries.

More than 5 million Employees Provident Fund (KWSP) members withdrew up to RM 10,000 per person from 20 April 2022. This represented 44% of the total KWSP members. This had led to more money to spend during the celebrations of upcoming festivals in May.

From 1 May 2022, new sets of Covid-19 SOP relaxations were implemented. MySejahtera check-in is no longer required. Entry into retail premises is allowed regardless of vaccination status except those with ‘High Risk’ status or under Home Surveillance Order (HSO). Physical distancing within retail premises is no longer required. In addition, all economic sectors are allowed to operate from 15 May 2022.

There were two long weekends’ holidays during the month of May. During Hari Raya Aidlfitri, Labour Day and Vesak Day, Malaysians were able to celebrate fully after 2 years of lockdowns. Retail sales during this period were very encouraging.

Shopping centres and main commercial centres throughout Malaysia began to attract large crowd started from 3 weeks before Hari Raya. The peak was one week before Hari Raya. Shopping traffic in major shopping malls stayed at high level even 2 weeks after the holidays.

During these festivals, major tourist towns and attractions in Kedah, Penang, Perak, Kuala Lumpur, Selangor, Melaka, Johor and Pahang were filled with domestic tourists.

The re-opening of international borders from April 1 has brought cheer to retail businesses that have been dependent on foreign tourists. Border towns located in Perlis, Kelantan and Johor witnesses more foreign visitors entering Malaysia.

With the encouraging initial response, Ministry of Tourism is targeting for at least 2 million foreign visitors by end of this year.

Shopping traffic has returned to pre-covid level. Shoppers are visiting physical outlets and dining in their favourite cafes and restaurants. However, Malaysia retail industry is still facing several major challenges for the rest of the year.

Prices of basic necessities continue to rise since beginning of this year. This supply-driven inflation has affected the purchasing power and lifestyles of Malaysians. This trend is expected to continue in the next few months.

Rise in food prices affects both costs of cooking at home and dining outside of house. Fresh produces, meats, fishes, dairy products, soy products, canned foods, cooking oils, etc. found in grocery stores (hawker stall, wet market, provision shop, mini-market, supermarket and hypermarket) are more expensive now. Thus, cooking at home costs more now. At the same time, majority of eateries have also increased their prices.

In addition to food prices, prices of household items have also risen. Prices of electrical goods and household appliances have increased by 10-20% this year. Higher material costs, transportation costs and staff cost led to this round of price adjustment.

Bank Negara Malaysia raised the overnight policy rate (OPR) by 25 basis point to 2.0% on 11 May 2022. This was the first rate hike since July 2020. Interest rate hike will take place again in the near future. This will further erode the purchasing power of Malaysians.

Started from 1 May 2022, the minimum wage increases from RM1,200 to RM1,500 across the country for companies that employ five or more staff. This has increased the cost of operation of Malaysian retailers.

Malaysia retail industry is anticipated to grow at 25.7% during the second quarter with contribution mainly from strong sales during the Hari Raya festival.

The third quarter growth rate is estimated at 3.4% due to a low base in the same period a year ago. Spending patterns should begin to normalise during this period.

For the last quarter of 2022, Malaysia retail industry is hopeful of a 3.6% growth rate after a rosy performance a year ago.

FOOD & BEVERAGE SECTOR

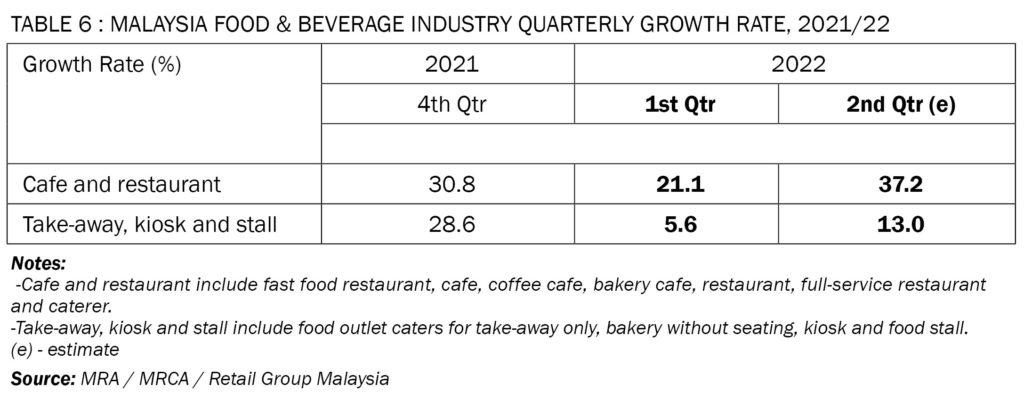

During the first quarter of 2022, food & beverage establishments continued to enjoy strong sales similar to the preceding quarter.

The Chinese New Year festival encouraged social gathering among families and friends in large restaurants.

Interstate travel during the long Chinese New Year holiday also boosted food outlets’ sales in tourist-dependent towns and resorts.

Food & Beverage Outlets (Cafe and Restaurant) recorded an encouraging growth rate of 21.1% during the first quarter of 2022, as compared to the same quarter a year ago (Table 6).

For Food & Beverage Outlets (Take-Away, Kiosk and Stall) that focused on take-away and delivery, its sales slowed down to 5.6% during the first quarter of 2022, as compared to the same period one year ago.

Night entertainment outlets have been allowed to re-open from May 15 after more than 2 years of closures. Visitors to these outlets are required to conduct mandatory self-test under the presence of a doctor 24 hours before entry. Only visitors with ‘low risk’ status are allowed to enter the premises. And visitors are required to turn on MySJ Trace feature in MySajahtera during their visits.

Higher food prices led to increasing costs for F&B operators in Malaysia. Since beginning of this year, many of F&B outlets (including hawker stalls, coffee shops, cafes, restaurants and national chain outlets) have raised their prices.

Despite the return of dine-in customers, many F&B outlets in Malaysia are not able to fully capitalise on this. Their outlets remain open, but they are not able to cope with the crowd due to shortage of kitchen staff and servers. Diners need to wait longer to get their foods. This was worsened during the recent long holidays in the month of May.

Cafe and restaurant operators are hopeful that their food business will climb by 37.2% during the second 3 months of this year, as compared to the same period a year ago.

Similarly, food and beverage kiosk and stall operators are optimistic of their business performance during the second quarter of 2022. They expect sales to rise by 13.0%.

Footnote:

- This report is provided as a service to members of MRA, MRCA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.