PREAMBLE

Members of Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA) were interviewed on their retail sales performances for the first half-year of 2021.

Last year had been the worst period for retailers in Malaysia since 1987. After witnessing tentative signs of retail recovery since end of last year, the hope for recovery this year was completely dashed recently when daily confirmed covid-19 cases jumped to historical highs.

Many retailers in Malaysia were hit hard when people avoided going to enclosed places such as shopping malls. After a series of new lockdowns have been introduced since beginning of May 2021, the light of hope at the end of the retail tunnel has been turned off temporarily.

The second quarter estimates (by members of MRA and MRCA) published in this report under ‘Next 3 Months’ Forecast’ were made before the announcements of MCO 3.0 and FMCO. Therefore, their projections are no longer accurate. New forecasts cannot be made at this current time due to the uncertainties in the covid-19 developments and lockdown restrictions within Malaysia.

LATEST RETAIL PERFORMANCE

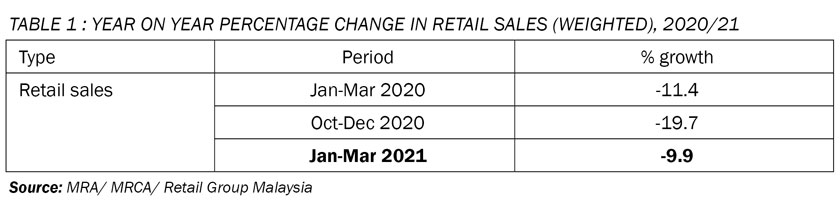

For the first quarter of 2021, Malaysia retail industry recorded a negative growth rate of 9.9% in retail sales, as compared to the same period in 2020 (Table 1).

This latest quarterly result was better than the estimate made by members of MRA and MRCA at -13.4% in March 2021.

Movement Control Order (or MCO 2.0) was reinstated from 13 January 2021 until 4 March 2021. During the initial period of this lockdown, majority of retail trades were ordered to shut down.

During the implementation of MCO 2.0, shopping traffic in major shopping malls in Malaysia dropped by 90% as compared to December 2020.

During this lockdown, many non-essential retail shops were allowed to open but with few customers during peak shopping hours. The situation was worse than retail businesses during MCO 1.0 in March 2020.

More retail businesses were allowed to open in stages from 5 February 2021.

Shopping traffic recovered when MCO 2.0 ended on 5 March this year. Shopping malls in all major cities received large crowds on the first weekend after MCO 2.0 was lifted. Some tourist areas had also received good crowd during the weekends.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

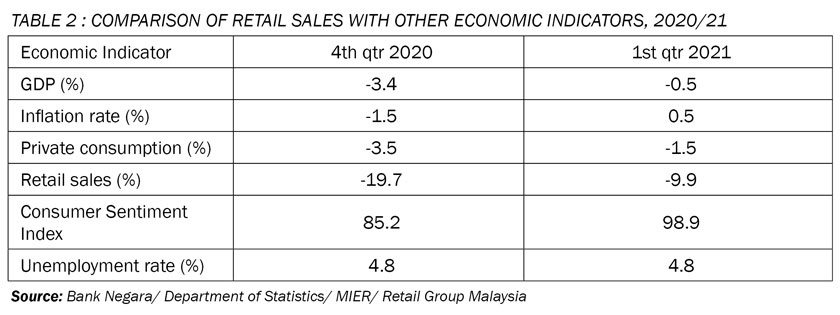

For the first quarter of 2021, Malaysia national economy recorded a contraction of 0.5% (Table 2, at constant prices), as compared to -9.9% for retail sales (at current prices).

The high demand for export products, especially E&E products, contributed to the economic growth during this quarter. The relaxation of movement control order since February also led to higher domestic demand for goods and services.

After 3 consecutive quarters of declines, the average inflation rate during the first quarter of 2021 turned positive at 0.5%. During the quarter, Malaysian consumers were faced with higher prices of Food & Non-Alcoholic Beverages (1.5%) as well as Miscellaneous Goods & Services (1.5%).

Private consumption declined by 1.5% during the first quarter of 2021 due to MCO 2.0.

During the latest quarter, the Consumer Sentiment Index (by MIER) achieved a 10-quarter high of 98.9 points. However, it was still below the 100-point threshold level of optimism.

Unemployment rate during the first quarter of 2021 remained unchanged at 4.8%.

RETAIL SUB-SECTORS’ SALES COMPARISON

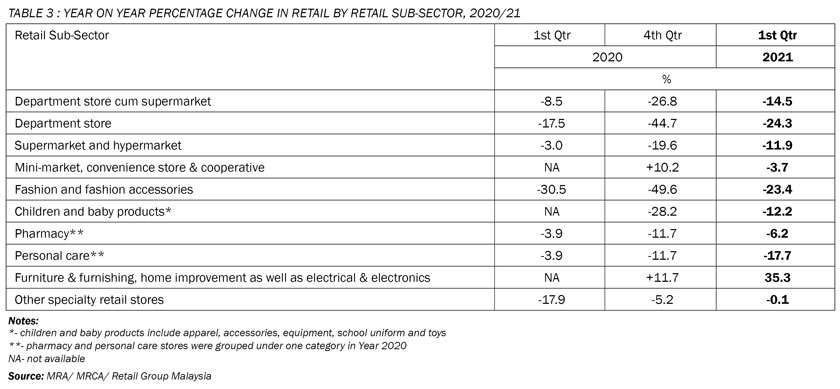

Covid-19 pandemic continued to affect the retail performances of almost all retail sub-sectors during the first quarter of 2021 (Table 3). The implementation of MCO 2.0 from 13 January 2021 led to poor retail results. The 4-digit daily confirmed cases had also discouraged shoppers to visit enclosed shopping places.

Department Store cum Supermarket sub-sector recorded a negative growth rate of 14.5% during the first quarter of 2021, as compared to the same period a year ago. During the first phase of MCO 2.0, the non-food section of this sub-sector was not allowed to open for business.

Department Store sub-sector had been suffering from significant drops in retail sales since the covid-19 pandemic. The business of this sub-sector decreased by 24.3% during first 3-month period of this year.

Despite being allowed to open throughout the virus pandemic, the Supermarket and Hypermarket sub-sector was still faced with lower retail sales as compared to pre-covid-19 period. Its business declined by 11.9% during the first quarter of 2021.

After a strong performance last year, the Mini-Market, Convenience Store & Cooperative experienced a slow down in retail sales with negative growth rate of 3.7% during the quarter.

During the first quarter of 2021, the Fashion and Fashion Accessories sub-sector recorded another poor result of -23.4% in growth rate. This sub-sector was ordered to shut down during the initial period of MCO 2.0.

The Children and Baby Products sub-sector recorded slower decline in retail sales with a -12.2% in growth rate during the first 3 months of this year.

During the first quarter of this year, Pharmacy sub-sector reported a growth rate of -6.2%, as compared to the same quarter a year ago. Similar to the grocery retailers, it is one of the least affected retail sub-sectors during this quarter.

The Personal Care sub-sector reported a poor retail result with -17.7% in growth rate during the first 3-month period of this year.

The Furniture & Furnishing, Home Improvement as well as Electrical & Electronics sub-sector enjoyed a strong growth rate of 35.3% during the first quarter of 2021. It was the best performer among the retail sub-sector.

The Other Specialty Stores sub-sector (including photo shop, fitness equipment store, ICT retail store, sporting goods’ store, store retailing musical instrument, optical store, second-hand goods’ store, shop selling baking ingredient, arts & crafts store as well as direct selling firm) achieved a near-zero growth rate (-0.1%) during the first quarter of 2021, as compared to the same period last year.

NEXT 3 MONTHS’ FORECAST

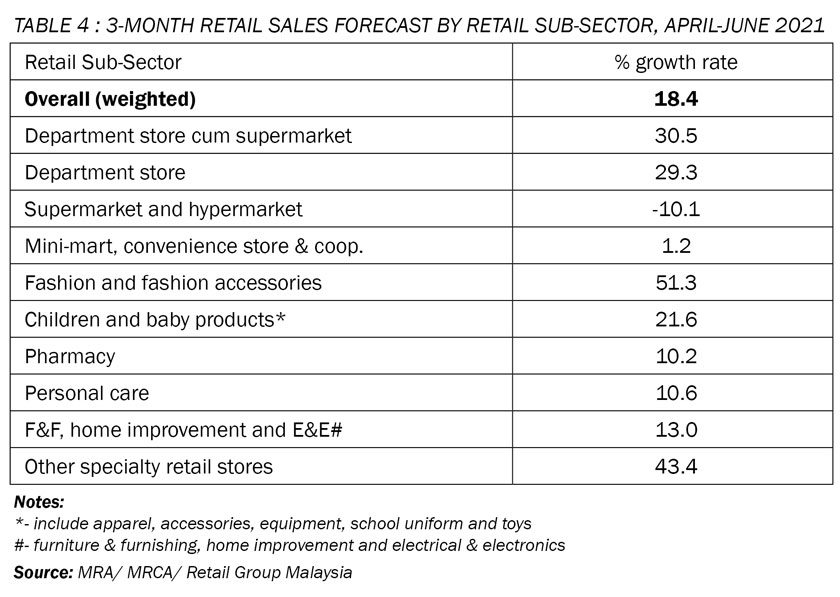

Members of the two retailers’ association project an average growth rate of 18.4 during the second quarter of 2021 (Table 4). However, majority of retailers gave their estimates before the new announcements of stricter rules and additional movement restrictions by the Malaysian government from early May 2021. In other words, the current estimates are not achievable.

The department store cum supermarket operators are expecting their sales to rebound strongly with a growth of 30.5% for the second quarter of this year.

The department store operators are expecting their businesses to recover with a growth rate of 29.3% for the second 3-month period of this year.

Although this sub-sector remains the least affected among the retail sub-sectors during this difficult period, supermarket and hypermarket operators will not see big improvement in their businesses in the coming months. They expect to remain in the red zone with a -10.1% growth rate for the second quarter of 2021.

Operators of mini-market, convenience store and cooperative are anticipating a mild recovery in their sales with a growth rate of 1.2% only.

Retailers in the fashion and fashion accessories sector expect their businesses to turn around with 51.3% in growth rate during the second quarter of 2021, as compared to the same period a year ago.

Retailers selling children and baby products are hopeful of strong growth at 21.6% during the second 3-month period of this year.

Pharmacy operators are optimistic of their retail sales during the second quarter of this year with a growth rate of 10.2%.

Retailers in the personal care sub-sector are expecting their businesses to record a growth rate of 10.6% for the second quarter of 2021.

Operators of furniture & furnishing, home improvement as well as electrical & electronics are expecting to maintain their growth at 13.0% during the second 3 months of this year.

Retailers in other specialty stores sub-sector (including photo shop, fitness equipment store, ICT retail store, sporting goods’ store, store retailing musical instrument, optical store, second-hand goods’ store, shop selling baking ingredient, arts & crafts store as well as direct selling firm) are equally optimistic. They expect their businesses to climb by 43.4% during the next 3-month period of 2021.

SECOND HALF OF 2021

In March this year, Retail Group Malaysia (RGM) estimated a 4.1% growth rate in retail sale for 2021. However, this projection needs to revise taking into consideration the re-introduction of Movement Control Order (or MCO 3.0) on 3 May 2021 as well as the latest Full Movement Control Order (FMCO) on 1 June 2021.

RGM revises Malaysia annual retail industry growth rate for 2021 from 4.1% to 4.0% (Table 5). Any extension of the 2-week complete lockdown will damage the retail industry further. Any delay on the re-opening of non-essential retailers after 2 weeks will lead to more closures.

This latest revision takes into consideration several recent developments that have direct impact on Malaysia retail industry this year.

After surging daily confirmed cases, MCO 3.0 had been re-imposed from 3 May 2021 and ended on 31 May 2021. During this period, majority of retailers suffered from poor sales when Malaysian shoppers avoided enclosed places.

Started from 1 June 2021, Phase 1 of FMCO will run for a period of 2 weeks. During this time, non-essential retailers have been ordered to shut down. Malaysians nationwide have been asked to stay at home. If the first phase of this full lockdown is successful, the government will commence Phase 2 for a period of 4 weeks with the re-opening of some sectors in the economy. After phase 2 ends, Malaysia will move into Phase 3 which is similar to MCO 3.0 with all economic sectors allow to operate with strict SOPs.

For the second quarter estimates given by members of MRA and MRCA (average at 18.4%), they are no longer attainable. Large majority of retailers gave their estimates before the announcements of MCO 3.0 and FMCO. In addition, Retail Group Malaysia (RGM) revises the growth rate for second quarter of 2021 from 7.0% (estimated in March 2021) to 5.6%.

Malaysian government will continue the lockdown beyond the 2-week FMCO with revised movement restrictions and ban on the opening of certain retail trades. Retail sales during the third quarter of 2021 will be affected as well. RGM revises the growth rate from 4.1% (estimated in March 2021) to 3.5% for this quarter.

Interstate travel ban is expected to be enforced for longer period of time and it has been affecting domestic tourism spending.

Travel bubbles with selected countries will likely to begin towards end of this year. Malaysia will witness rising foreign tourist arrivals only from first half of next year.

Vaccination on majority of the population will take a while. Thus, movement restrictions and social distancing measures will remain until end of this year.

RGM expects retail industry to begin its gradual recovery by the end of this year. For the fourth quarter of 2021, retail industry is expected to grow by 12.7% (instead of 13.9% estimated in March 2021), as compared to the same period a year ago.

FOOD & BEVERAGE SECTOR

When MCO 2.0 began from 13 January 2021, dine-in was not allowed. All F&B outlets could only provide take-away and delivery. In addition, all F&B outlets must close by 8pm. These rulings affected the businesses of F&B operators.

From 22 January 2021, the operation hour was extended until 10pm. Subsequently, dine-in was allowed from 10 February 2021.

Started from 5 March 2021, Malaysia transited into Conditional Movement Control Order (CMCO). During this period, F&B outlets were allowed to operate as usual with social distancing measures.

Food & Beverage Outlets (Cafe and Restaurant) recorded a negative growth rate of 6.2% during the first quarter of 2021, as compared to the same quarter a year ago (Table 6).

For Food & Beverage Outlets (Take-Away, Kiosk and Stall) that focused on take-away and delivery, its business dropped as well. For the first quarter of 2021, its sale declined by 9.5%, as compared to the same period one year ago.

CMCO ended on 3 May 2021 and MCO was re-implemented when daily covid-19 cases climbed sharply. Dine-in was forbittened again during MCO 3.0.

Commencing from 1 June 2021, FMCO was introduced that required majority of Malaysians to stay home.

Cafe and restaurant operators are foreseeing their businesses to maintain for the second 3 months of this year. They expect their food business to grow marginally by 0.5% as compared to the same period last year.

On the other hand, food and beverage kiosk and stall operators are pessimistic of their business performance during the second quarter of 2021. They expect sales to drop by 11.6%.

Majority of F&B operators submitted their second quarter projections prior to the introduction of MCO 3.0. Therefore, the final results are likely to be worse off.

Footnote:

- MCO 1.0 started on 18 March 2020 and ended on 3 May 2020.

- MCO 2.0 commenced on 11 January 2021 and exited after 4 March 2021.

- MCO 3.0 was implemented on 3 May 2021 and transited to FMCO after 31 May 2021.

- This report is provided as a service to members of MRA, MRCA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association, Malaysia Retail Chain Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA, MRCA and their members.

- For more information, please write to tanhaihsin@yahoo.com.

[…] Source: https://ifranchisemalaysia.com/malaysia-retail-industry-report-june-2021-compiled-and-written-by-ret… […]