Members of the Malaysia Retailers Association (MRA) were interviewed on their retail sales performances for the first half-year of 2020.

This year has been the worst period for retailers in Malaysia since 1987. The retail market turned into a bloodbath since the middle of March with the implementation of the Movement Control Order (MCO).

LATEST RETAIL PERFORMANCE

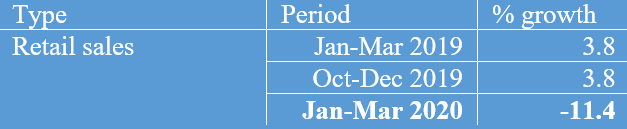

For the first quarter of 2020, the Malaysian retail industry recorded a negative growth rate of 11.4% in retail sales, as compared to the same period in 2019 (Table 1).

This latest quarterly result was better than the estimate made by Retail Group Malaysia at -18.8% in April 2020.

TABLE 1: YEAR ON YEAR PERCENTAGE CHANGE IN RETAIL SALES (WEIGHTED), 2019/20

Source: MRA/ Retail Group Malaysia

During the second month of this year, retailers began to suffer from declining sales due to the rapid spread of COVID-19 and the drastic drop of foreign tourists. Retailers badly affected were those non-essential retailers.

The fear of the virus pandemic had affected consumers’ spending during the first 2 weeks of March 2020.

Movement Control Order (or commonly referred to as MCO or PKP) started on 18 March 2020 as a preventive measure by the Malaysian government in response to the COVID-19 pandemic in the country. This partial lockdown on the last 2 weeks of March led to zero revenue for non-essential retailers in the whole country.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

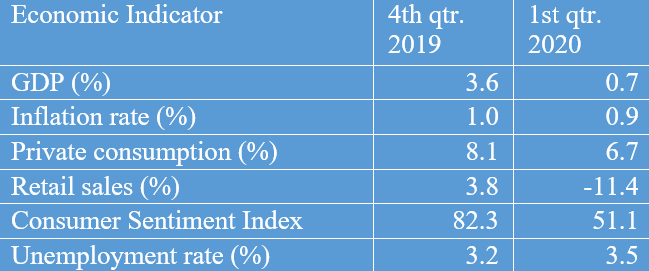

TABLE 2: COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS, 2019/20

Source: Bank Negara/ Department of Statistics/ MIER/Retail Group Malaysia

For the first quarter of 2020, Malaysia’s national economy recorded a low growth rate of 0.7% (Table 2, at constant prices), as compared to -11.4% for retail sales (at current prices).

Covid-19 pandemic was the main cause of slow growth during this period. It was the lowest growth rate since third quarter of 2009.

The average inflation rate during the first quarter of 2020 slowed down to 0.9%. The consumer price indices recorded relatively higher rates in January (1.6%) and February (1.3%) but declined sharply in March (0.2%).

Private consumption grew at a slower pace during the first quarter of 2020 at a growth rate of 6.7%.

During the latest quarter, the Consumer Sentiment Index (by MIER) dropped sharply to 51.1. It was the lowest since 1988.

The unemployment rate during the first quarter of 2020 climbed to 3.5%. During the month of March, the unemployment rate climbed to 3.9%, which was the highest recorded in the country since June 2010.

RETAIL SUB-SECTORS’ SALES COMPARISON

Covid-19 pandemic affected the retail performances of all retail sub-sectors during the first quarter of 2020 (Table 3).

Department Store cum Supermarket sub-sector recorded a negative growth rate of 8.5% during the first quarter of 2020, as compared to the same period a year ago. The food business of this sub-sector cushioned the negative impact of the Movement Control Order (MCO) in March 2020.

Covid-19 pandemic, lower tourist arrival, and MCO led to the poor retail sales performance of the Department Store sub-sector. The business of this sub-sector decreased by 17.5% during the first 3-month period of this year.

The Supermarket and Hypermarket sub-sector was the least affected retail sub-sector during this crisis. Its business declined by 3.0% during the first quarter of 2020.

During the first quarter of 2020, the Fashion and Fashion Accessories sub-sector recorded a poor result of -30.5% in growth rate. This was the worst-performing retail sub-sector during this period.

During the first 3 months of this year, the Pharmacy and Personal Care sub-sector reported a growth rate of -3.9%, as compared to the same quarter a year ago. Similar to grocery retailers, it is one of the least affected retail sub-sectors during this quarter.

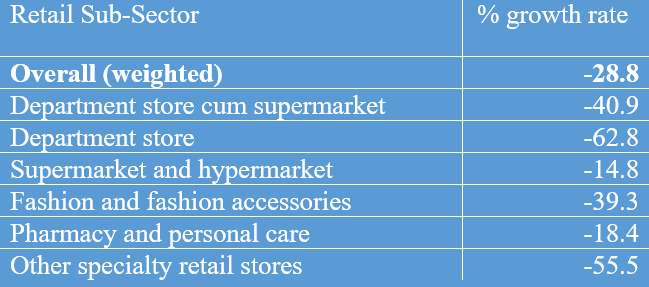

TABLE 3: YEAR ON YEAR PERCENTAGE CHANGE IN RETAIL SALES BY RETAIL SUB-SECTOR, 2019/20

Source: MRA/Retail Group Malaysia

The Other Specialty Stores sub-sector (including retailers selling photographic equipment, optical products, children-related goods, second-hand goods, toys as well as arts & crafts) suffered a drastic drop in retail businesses with a growth rate of -17.9% during the first quarter of 2020, as compared to the same period last year.

NEXT 3 MONTHS’ FORECAST

Members of the retailers’ association project an average growth rate of -28.8 during the second quarter of 2020 (Table 4). This is worse than the projection made by Retail Group Malaysia in April 2020 at -9.3%.

The department store cum supermarket operators are expecting a dismal performance with a growth of -40.9% for the second quarter of this year.

The department store operators are expecting the worst in their businesses with a growth rate of -62.8% for the second 3-month period of this year. This sub-sector will be the worst performer among the retail sub-sectors during this quarter.

Supermarket and hypermarket operators will not see a big improvement in their businesses in the coming months. They expect to remain in the red zone with a -14.8% growth rate for the second quarter of 2020. This sub-sector remains the least affected business among the retail sub-sectors during these trying times.

TABLE 4: 3-MONTH RETAIL SALES FORECAST BY RETAIL SUB-SECTOR, APRIL-JUNE 2020

Source: MRA/Retail Group Malaysia

Retailers in the fashion and fashion accessories sector expect their businesses to suffer a drop of 39.3% in growth rate during the second quarter of 2020, as compared to the same period a year ago.

Retailers in the Pharmacy and Personal Care sub-sector are expecting their businesses to record a growth rate of -18.4% for the second quarter of 2020.

Retailers in Other Specialty Stores sub-sector (including retailers selling photographic equipment, optical products, children-related goods, second-hand goods, toys as well as arts & craft) are equally pessimistic. They expect their businesses to decline by 55.5% during the second 3-month period of 2020.

SECOND HALF OF 2020

Movement Control Order ended on 3 May 2020. Conditioning Movement Control Order (CMCO) started on May 4 and ended on June 9. During this period, the majority of retail shops and shopping centers were allowed to open by adhering to the Standard of Procedures (SOPs) set by the Malaysian government.

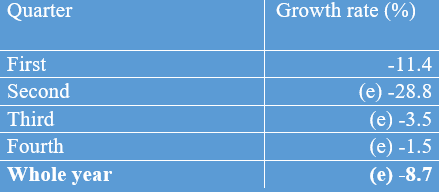

TABLE 5: MALAYSIA RETAIL INDUSTRY QUARTERLY GROWTH RATE, 2020

(e) – estimate

Source: Retail Group Malaysia

Recovery Movement Control Order (RMCO) commenced on 10 June 2020 and it is expected to end on 31 August 2020. More services have been allowed to open for business. Inter-state travel among the general public has been permitted as well.

With strict social distancing measures continue to be enforced, retailers would not be able to operate at full capacity as last year. For the third quarter of this year, a retail sale is expected to suffer a moderate decline of 3.5% as compared to last year.

In the event MCO is lifted fully before October, Malaysian retailers should expect retail business to begin its recovery. For the fourth quarter of this year, a retail sale is expected to decrease slightly by 1.5%.

The annual retail growth rate for Malaysia in 2020 is projected by Retail Group Malaysia to be -8.7%, as compared to last year. It has been revised downwards from the projection made in April at -5.5%.

Compiled and Written by Retail Group Malaysia.

Footnote :

- This report is provided as a service to members of MRA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organization without written permission from Malaysia Retailers Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions, and views expressed in this report are of writer’s own, and they are not necessarily the comments, opinions, and views of MRA and their members.

For more information, please write to tanhaihsin@yahoo.com.