PREAMBLE

Members of Malaysia Retailers Association (MRA) were interviewed on their retail sales performances for the second half of 2015.

LATEST RETAIL PERFORMANCE

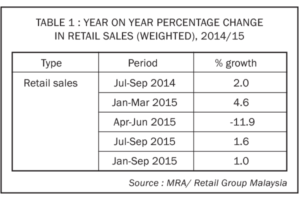

For the third quarter of 2015, Malaysia retail industry recorded another lower-than-expected growth rate of 1.6% in retail sales, as compared to the same period in 2014 (Table 1).

Malaysia retail industry had yet to recover from the negative impact of Goods & Services Tax (GST) on consumers’ spending. The unexpected drop in Ringgit value worsened it.

This quarterly performance is above the average growth rate of 0.1% forecasted by members of MRA in August 2015, but below the expected growth rate of 2.5% calculated by Retail Group Malaysia.

Malaysian Bumiputras returned to shop for their festival 2 weeks before Hari Raya in July. However, the retail sales were still discouraging as compared to last year.

The political development in Malaysia affected retail sales indirectly during the third quarter. The political situation was affecting the consumer sentiment level and buying mood of Malaysian consumers. As a result, they were spending less.

For the first 9 months of 2015, Malaysia retail industry grew by a mere 1.0% as compared to the same period a year ago.

Once again, retailers continued to sacrifice their bottom lines in order to get more shoppers to buy by offering heavy price discounts. During this latest quarter, they suffered decline in profit margin growth.

COMPARISON OF RETAIL SALES WITH OTHER ECONOMIC INDICATORS

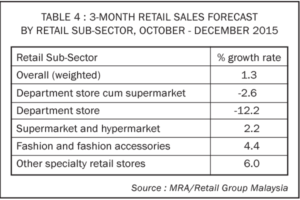

For the third quarter of 2015, Malaysia national economy recorded a slower growth rate of 4.7% (Table 2, at constant prices), as compared to 1.6% for retail sales (at current prices).

Inflation rate continued to move up to 3.0% during the third quarter of 2015 due to rising prices of goods and services. Except transportation, all sectors recorded price increases.

Private consumption grew at a slower pace at 4.1% during the third quarter of 2015 due to the implementation of GST.

During the latest quarter, the Consumer Sentiment Index (by MIER) dropped to a new low of 70.2. This was due to rising cost of living and concerns of job prospect. Unemployment rate rose slightly to 3.2% as compared to the same period in 2014.

RETAIL SUB-SECTORS’ SALES COMPARISON

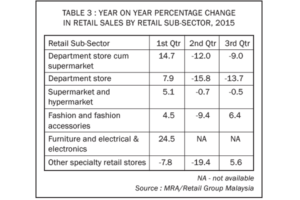

The latest quarterly growth rate was supported solely by specialty retail stores. Large-format retailers continued to face challenges during the quarter (Table 3).

Similar to the previous quarter, Department Store cum Supermarket sub-sector suffered a drop in retail business by 9.0% during the third quarter of 2015, as compared to the same period a year ago.

The business of Department Store sub-sector did not improved. It recorded another around of negative growth at 13.7% during the third 3-month period of this year.

The Supermarket and Hypermarket sub-sector reported another period of decline with a negative growth of 0.5% for the third quarter of 2015.

Fashion and Fashion Accessories sub-sector managed to turnaround with a strong growth of 6.4% during the third quarter of this year.

The Other Specialty Stores sub-sector (including retailers selling photographic equipment with photo processing services, sports-related goods, children-related goods, optical products, second-hand goods, souvenirs and gifts, toys as well as restaurants) enjoyed a positive quarterly growth for the first time this year. For the third quarter of 2015, the business of this sub-sector reported a 5.6% growth as compared to the same period last year.

NEXT 3 MONTHS’ FORECAST

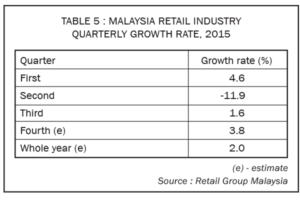

Once again, members of the retailers’ association do not expect their businesses to recover strongly during the last quarter of 2015. For the period between October and December, retail industry is expected to register a small growth of 1.3% (Table 4), as compared to the same period a year ago.

The department store cum supermarket operators are expecting their decline in business to slow down significantly with a – 2.6% growth rate for the fourth quarter of this year. Again, the department store operators are expecting their businesses to remain in the red with a negative growth rate of 12.2% for the last quarter of this year.

After two consecutive quarterly declines, supermarket and hypermarket operators are expecting a recovery with 2.2% in growth rate for the fourth quarter of 2015.

Retailers in the fashion and fashion accessories sector expect their businesses to maintain the recovery momentum with a positive growth of 4.4% during the last 3-month period of 2015.

The Other Specialty Stores sub-sector (including retailers selling photographic equipment with photo processing services, sports-related goods, children-related goods, optical products, second-hand goods, souvenirs and gifts, toys as well as restaurants) are hopeful to maintain their growth at 6.0% for the final quarter of 2015, as compared to the same period a year ago.

THE REST OF 2015

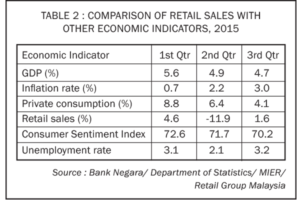

The projected retail sales growth rate of Malaysia retail industry in 2015 by Retail Group Malaysia has been revised downwards further for the fifth time from 3.1% to 2.0% (Table 5) due to the poor retail figures achieved during the second and third quarters of this year.

The weak Ringgit performance during the last several months has resulted in higher import costs. Higher import costs have affected all retail sub-sectors. Higher retail prices since September this year have further deteriorated the purchasing power of Malaysian consumers.

For the last quarter of this year, the estimated retail growth rate has been revised downwards to 3.8% (from 6.0% projected in August 2015), as compared to the same period in 2014.

MRA members anticipated a lower growth rate of 1.3% for the last quarter of 2015. However, Retail Group Malaysia is more optimistic (at 3.8%). The year-end school holiday and festive season should lift the buying spirit of Malaysian consumers. The higher cost of overseas travelling due to weak Ringgit will encourage more domestic spending as well.

2016 FORECAST

Budget 2016 announced in end October did not offer sufficient policies and incentives to stimulate consumers’ spending in the first half of 2016.

Recent increases in prices of toll rates (started in October) and rails’ ticket prices (started in December) have increased the cost of living of Klang Valley population, the largest contributor to Malaysian retail market. Higher transportation costs will also lead to another round of increases in prices of retail goods and services during the first quarter of 2016 due to higher business operation costs.

Malaysian currency is not expected to climb back to 2014 level within the first 6 months of 2016. This will add more pressure to importers of raw materials, semi-finished goods and finished goods that are meant for final consumption by Malaysians. Another possible hikes in prices of retail goods and services from the second quarter of 2016 will result in further deterioration of spending power of Malaysian consumers.

Based on the above, Retail Group Malaysia forecasts 4.0% growth rate for Malaysia retail industry in 2016.

Footnote :

- This report is provided as a service to members of MRA and the retail industry. It provides industry data that give retailers better analytical tools for running their retail businesses.

- This report is not allowed to be reproduced or duplicated, in whole or part, for any person or organisation without written permission from Malaysia Retailers Association or Retail Group Malaysia.

- Retail Group Malaysia is an independent retail research firm in Malaysia. The comments, opinions and views expressed in this report are of writer’s own, and they are not necessary the comments, opinions and views of MRA and their members.

- For more information, please write to tanhaihsin@yahoo.com.

Dear Sir / Madam,

My name is Poorni Sakrabani and I am doing my doctorate on the Malaysian retail industry. I would really appreciate it if you could provide me with the 4th quarter retail industry report FY2017 and 2019 as I need to use it as supporting documents for my thesis.

Your kind cooperation will be most appreciated.

Thank you.

Poorni Sakrabani

DBA student

Universiti Sains Malaysia

Email add: psbani2804@gmail.com